In December last year we wrote a note on the outlook for the bond market. Spreads had widened significantly, and an exciting opportunity was presented to take advantage of depressed asset prices and higher yields. We still believe this opportunity exists.

Last month’s pain

This said, February was the worst month for bonds since 1981. Yields rose over the month, as stronger consumer spending in January suggested the Federal Reserve have more headroom to keep interest rates higher for longer, without the need to soften policy due to recessionary pressures. The US treasury yield rose from 3.5% at the beginning of the month, to 3.9% at the end. UK gilts moved from 3.3% to 3.8% (yields rise when prices fall).

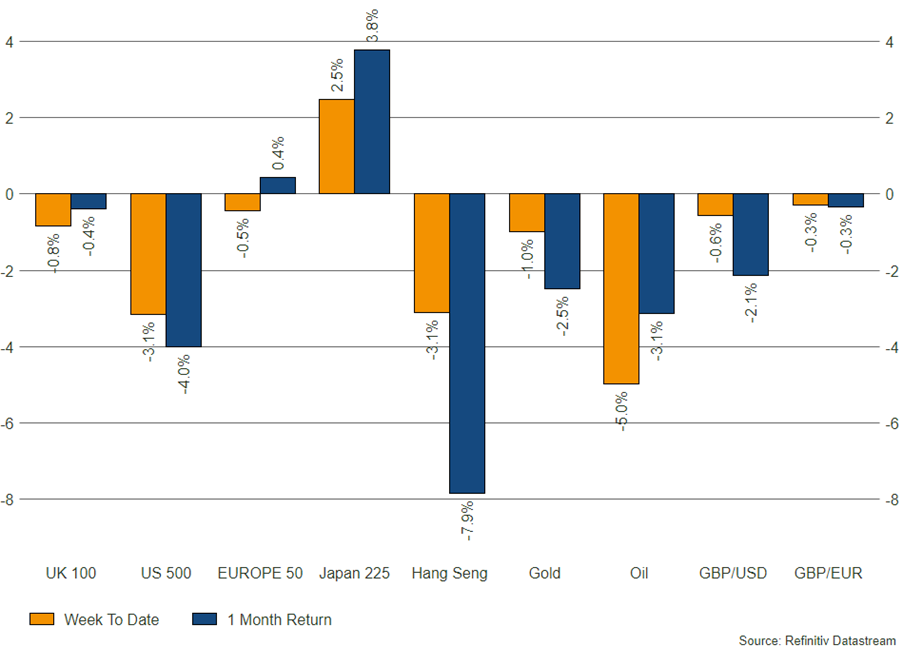

It wasn’t just bonds that sold off, as equities saw their strong January returns tempered by ongoing concern around the direction rates are still travelling. Global equities fell 2.5% in US dollar terms, and the greenback strengthened against sterling by 2.4% as revised policy expectations were priced in.

So why bother with bonds?

Despite this shake out, the entry point for investors remains attractive.

Over more than a decade, yields have remained depressed as rock bottom interest rates have supported a bull market for bonds. With prices elevated and income so low, it became harder to justify the use of fixed interest assets to provide income and capital protection in portfolios. However, the drawdown seen in bond markets over the course of 2022, and indeed February this year, allows us to take advantage of higher yields and the possibility for some capital appreciation when the interest rate environment rotates. (When rates fall, prices tend to rise.)

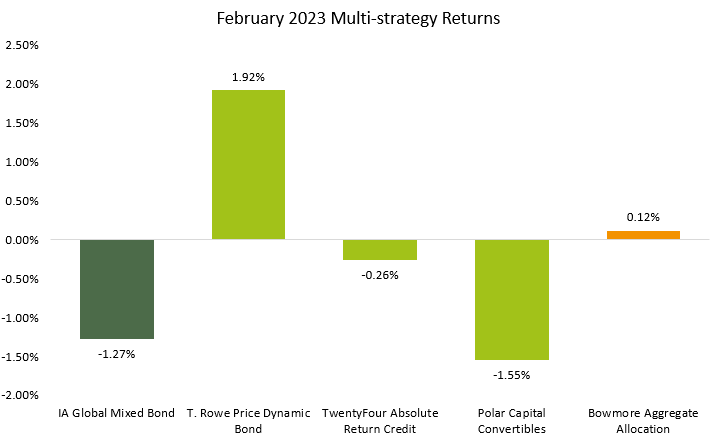

With this in mind, an active approach to bond allocation can yield relative returns that are far more attractive than the market suggests. Our own allocation to multi-strategy bond funds had a strong month in February when compared to the IA Global Mixed Bond sector:

Source: Morningstar

Bowmore portfolios

As shown in the chart above, we can allocate to different strategies and generate diverse returns at a time when bonds came under extreme pressure. On aggregate, the core multi-strategy allocations have outperformed the Global Mixed Bond index by 1.15%. This is pleasing to see, and it comes at a time when our active managers have the opportunity to leverage a much more compelling outlook for the bond market and be selective in their approach.

Source: Refinitiv – Market returns as at 09/03/2023