I want to invest

Your future, our focus

Whatever your reason for choosing to invest – whether you’re planning your retirement income, building a nest egg for the future, planning school fees or investing the proceeds of an inheritance – our innovative approach centres on how we can help you achieve your personal objectives.

A portfolio to match your values, goals and attitude to risk

Our investment philosophy is underpinned by rigorous, long-term academic research and observation of the markets. But it is our clients’ objectives that shape the portfolios we build. Your values, objectives, aspirations and attitude to risk will form the mandate we use to build and manage your investments.

Working together in this way allows us to ensure you have the strongest chance of achieving your objectives and that you both understand and believe in the investment journey we are taking.

We give all our clients a bespoke blend to achieve their objectives

core

active/passive

esg

income

Building your portfolio

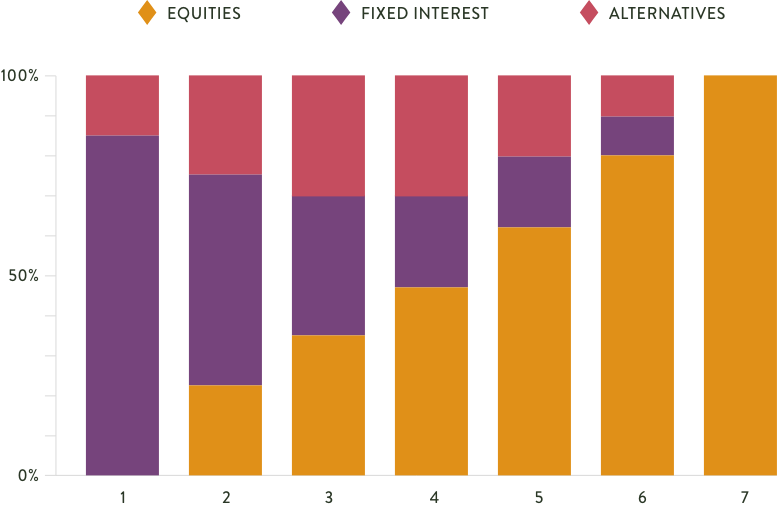

At Bowmore Asset Management, we invest across three major asset classes: equities (stocks), fixed interest investments (bonds), and alternative assets. The term “alternative assets” encompasses a wide range of investment opportunities such as hedger funds, structured products and property.

Our innovative approach

Regardless of your risk profile, all Bowmore Asset Management clients have access to our best ideas and exposure to the same investment opportunities. Our innovative approach has helped us, in some instances, realise enhanced investment returns for our clients.

Managing risk

We understand investment risk and have designed robust portfolios to reflect this with proven downside protection.

The risks we face today are very different from those we faced a decade ago but our portfolios are carefully designed to reduce risk, increase returns and align with our clients’ objectives.

This represents typical asset allocation positioning but will change depending on our current market views.

Across all mandates we offer seven different risk grades with the blend of investments changing the further up the scale you go – “1” being the most cautious approach to risk and “7” being the most adventurous. Typically, clients will have a greater weighting of fixed interest investments in their portfolio at the lower end of the risk scale, with equity being given a greater proportion at the higher end.

Offering these seven different grades enables us to ensure we accurately reflect clients’ appetite for risk, regardless of investment mandate.

Performance

Our performance is reported and measured, our extensive Factsheets section on our site can provide more detail around the performance of our portfolios.

Find our more about our portfolios here:

FactsheetsPlease note: the value of your investments and any income derived from them may go down as well as up and you may not get back the money you invested. Historical data on returns should not be taken as a guarantee of future performance.