As people around the world have been celebrating Lunar New Year this week, the year of the rabbit, we wanted to look at some of the market drivers for China in 2023. Last year, China welcomed the Winter Olympics; President Xi Jinping was elected for a third mandate as General Secretary of the Chinese Communist Party (CCCP), and more recently we saw China relax its zero-Covid stance. It was a difficult year for Chinese assets, with the broad index down 21.9% over the 12 months. Will the year of the rabbit be more prosperous for investors?

Post-Covid era

In December, China dropped all Covid restrictions in a bid to improve public sentiment and re-open its economy faster than expected. As in other developed countries, Chinese consumption has remained below its long-term trend during its battle with Covid, and with the savings rate at elevated levels, the Chinese public have amassed large amounts of cash in savings. The re-opening of the economy will be supported by a recovery in consumer spending, which will strengthen earnings in most sectors and restore some confidence, which had fallen to all-time lows. With borders opening again, tourism and the service sector should also start to recover and economic activity in China has already improved.

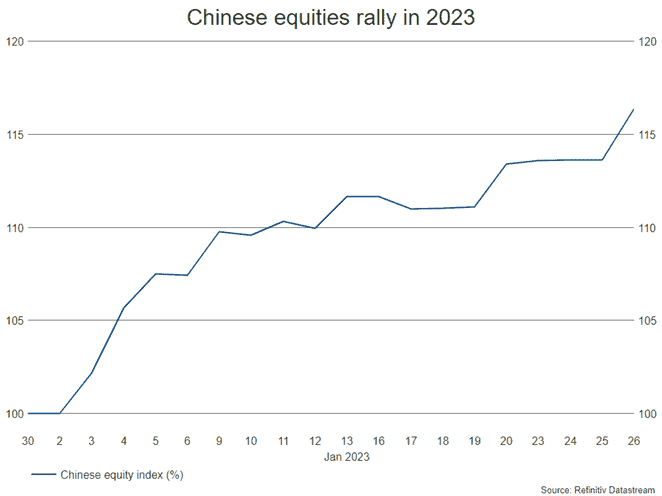

This positivity has fed into markets, with Chinese equities rallying hard in the early stages of 2023; the broad index is up 16.4% in local currency terms year to date:

Source: Refinitiv

Economic activity

Markets are expecting Chinese monetary policy to align with the government’s fiscal policies in order to prioritise growth in 2023, with the International Monetary Fund expecting growth to improve year on year. On the monetary side, the Bank of China will likely continue to ease policy, with more rate cuts in the coming months. Meanwhile, the government has already announced plans to expand fiscal spending to aid economic recovery.

After a contraction in property and land investment, the Chinese authorities recently issued a set of measures aimed at providing credit support for property developers. Housing demand may improve on the back of a recovery; mortgage rates are currently at their lowest point since 2009.

Other headwinds for Chinese assets also appear to be stabilising. The wave of regulations we saw come into effect in 2021 that hit many internet platforms, gaming and education companies has now been implemented and absorbed. In addition, if we continue to see a weaker US dollar, as widely expected this year, it will help support a resurgent Chinese economy.

Bowmore portfolios

We have held a direct, active allocation to China within our core portfolios for some time. Though we have experienced a difficult period for Chinese equities, we believe valuations remain attractive, especially as they have fallen over the last couple of years relative to global peers. Forecasters are anticipating China’s economy to strengthen in 2023, with expected growth at 4.4% compared to around 3.2% in 2022. While the recovery path for markets is not fully clear, we see an opportunity for our selected active managers to leverage, particularly within the loose monetary framework currently at play in China.