Key Takeaways

- August was a volatile month for markets, with global equities down 2.6%

- Macro-economic data has been more positive, driving expectation of further interest rate hikes.

- US growth at an annualised 2.1% for Q2 2023.

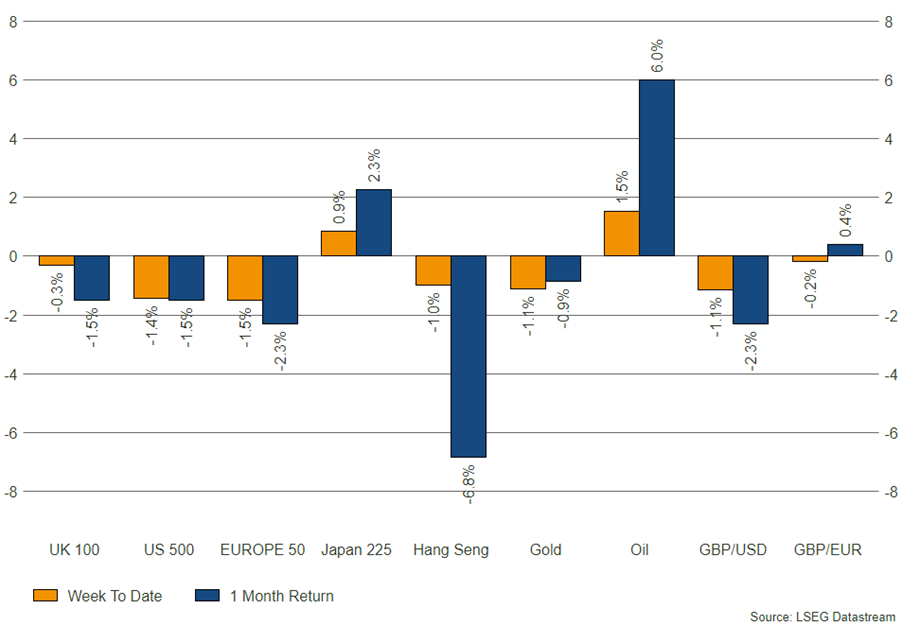

August was tricky for markets to navigate. Global equities fell 2.6% in US dollar terms, and bond yields rose, with the US 10-year treasury yield reaching 4.09%, up from 3.96% at the start of the month (yields rise when prices fall). Whilst investors saw values move lower, returns were, perhaps counter-intuitively, reflective of more positive economic data.

Macro positives

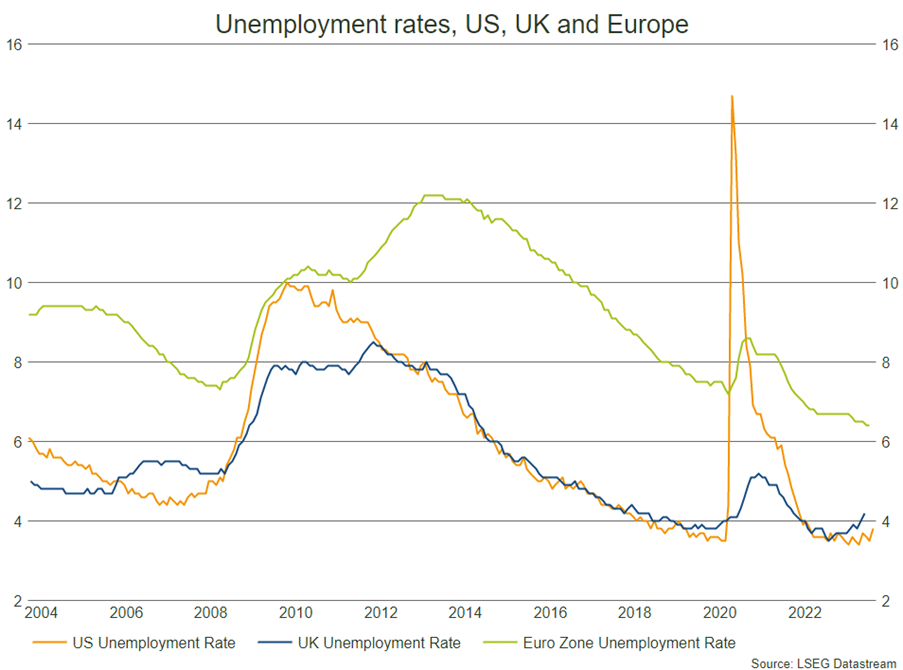

US GDP growth readings beat estimates at the end of July, and although this number was revised down in August, second quarter annualised growth is expected to be 2.1%. In addition, US jobless claims this week registered lower than expected and at their lowest level since February this year. This is hardly surprising, with the unemployment rate in the US at 3.8% and close to all-time lows.

It’s a similar story in the UK and Europe. With unemployment at 6.4% in Europe for July, more Europeans are employed than ever, since records began in the ’90s, and although we have seen a rise in unemployment in the UK, numbers are still below the long-term trend. Growth has remained relatively flat over the last few quarters, meaning both regions have staved off a contraction.

Source: Refinitiv

Although macro-economic data like this is no bad thing, it does give central banks more rope when it comes to monetary policy. If an economy is in better health, it can theoretically cope with higher rates or tighter policy as the battle on inflation continues. Though inflation has been falling, it remains above targets, and recent positive data has left investors feeling the US Federal Reserve will hike once again. This has caused markets to pause for thought after a strong run through June and July.

Bowmore portfolios

Whilst portfolios are not immune from market volatility, it is important at times of stress to hold diversifiers, which spread risk exposure. Allocations to short dated high yield bonds and company credit held up well in August. Both our US large-cap and Indian equity exposures were up in sterling terms in the down market, and within our alternatives allocation, the Trium Emissions and Graham Macro funds returned 3.1% and 1.4% respectively, providing uncorrelated, positive performance compared to the wider market.