Key Takeaways

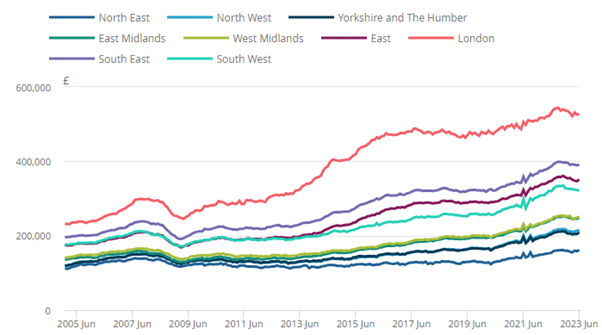

- The average house price in the UK is still 2% below its 2022 peak

- Housing supply continues to outpace buyer enquiries for the 20th consecutive month

- 26% of the average persons disposable income is absorbed by mortgage repayments at present, c.6% above the historical average

It’s been a rough ride for UK property since its peak in November 2022 – but we believe that several important factors look set to calm the water by the end of this year. Demand is picking up with the number of mortgage approvals continuing to rise (currently at a six-month peak with 50,500 agreements in December) and new buyer enquiries are up to +7 in January from -3 in December. Housing supply should continue to rise with the broader recovery in demand as those postponed selling last year reevaluate, and the number of people being forced to sell up remains low.

More reasons for optimism can be found in the resilience of homeowner’s finances and broad declines in the quoted mortgage rate. Mortgage arrears remain well below the levels reached during the global financial crisis back in 2007 and although redundancy notifications are slightly elevated (116,000 were made back in December), we still aren’t seeing concerning signs of widespread job cuts. With the average quoted rate for a two-year fixed-rate mortgage with a 75% LTV ratio falling to an eight-month low of 4.73% in January, from 5.03% in December affordability is on the rise too. Tax changes and interest rate increases persuaded non-commercial landlords out of the market and put many off the asset class with 151,000 buy to let homes sold last tax year– a theme that may reverse helped by increased rental value now available.

Average UK house price by English region

Source: ONS

House prices are political

Increased confidence because of higher house prices is economically and politically favourable – especially for a government hoping to stay in power when they are currently trailing Labour by 20% in the polls. While we wait for the Chancellor to deliver the budget on 6th March, rumours are circling that tax cuts could be in sight after a record budget surplus.

Speculations include:

- Reversal of the planned Stamp Duty Land Tax increase in 2025

- Homebuilding pledges, currently set at one million homes by the end of this Parliament

- Take 2% off the 20% basic rate of income tax, costing GBP14bn

- Cut another 1% off National Insurance, costing GBP5bn

Bowmore portfolios

We currently allocate to Picton Property Income, a UK REIT (real estate investment trust) that owns and manages commercial property within the industrial, office and retail spaces and is currently yielding 5.4%. While the wider property sector has suffered in the last two years, at a portfolio level Picton has outperformed the index in each of the past 10 years, delivering upper quartile performance since inception in 2005. It’s current loan to value is 26.4% and 90% of its debt is secured at 3.8% until 2031.

There lies a significant opportunity within the fund as rents continue to increase across all sectors to close the wide (£13.2m at H1) gap between current payable rents and the ERV (estimated rental value on the open market). We also expect the upcoming interest rate declines to have a restorative affect on capital values (which are still an average of 25% lower than their peak in 2022).