- The largest 10 M&A deals in the bio-pharma industry totalled $115.8 billion in 2023

- The current median world age is 30.5 years old

- The US senior population is expected to reach 83 million by 2025 (currently at 55 million)

While the COVID vaccine race – and then obesity drugs like Ozempic and Wegovy – and now the resignation of Oprah Winfrey from the Weightwatchers board has been dominating healthcare headlines for some time, longer term trends have been emerging which will help shape the healthcare industry.

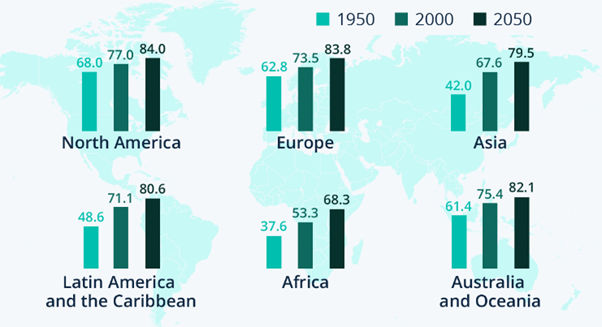

Estimated life expectancy at birth for both sexes

Source: Statista

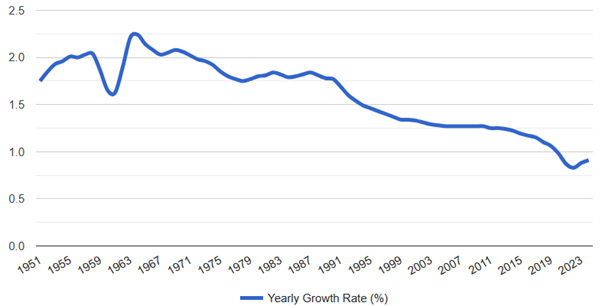

Yearly world population growth rate

Source: Worldometer

A theme that’s been going strong for longer than 200 years and is relative to us all is increased life expectancy. This coupled with a sustained population growth rate decline means that the worlds average is slowly rising – and life expectancy will continue to increase. These changes are mostly driven by technological advances, education and a declining fertility rate. Though this creates a formidable demographic challenge – opportunities within the healthcare sector exist to take advantage of these changes.

Key themes for the next 10 years

- Healthcare delivery disruption

- Innovation in oncology, cell therapy and vaccines

- Workforce cost increases

- Infrastructure spending

- Corporate activity

- Emerging market growth of consumption

- Medicine cost increase

- Prevention of disease via diagnostics, vaccines and remote testing

Outlook

We believe that optimism is warranted toward the healthcare sector. First, the utilisation story continues to be fuelled by positive earnings reports; second, the sheer volume of new and innovative products being launched by a diverse range of businesses should drive strong earnings growth for years to come; and last, M&A is currently very active. Each of these factors should be supportive for healthcare on the whole, and drive investment.

Bowmore portfolios

We presently allocate to Polar Capital’s healthcare opportunities fund within our core mandate which invests in 40-45 large and medium cap names within the sector. A major theme within the fund at present with a c.49.1% allocation is biotechnology – an area of significant innovation, potential for consolidation and currently trading at the lower end of its historical range.

The fund has strongly performed year to date, returning some 17.76% to investors. Its benefited namely from Zealand Pharma’s obesity drug pipeline strength, India’s bull market in hospital development and strong earnings in Q4 of 2023. With more positive news flow and expected M&A activity in the pipeline, we maintain a positive stance to the sector.