Key takeaways

• Alphabet, Apple, Meta, Nvidia, Amazon, Microsoft and Tesla have gained more than $2.1 trillion in market capitalisation year to date.

• These seven stocks account for 88% of the US large-cap index return.

• Bowmore portfolios have taken part in the US equity rally this year.

US tech struggled last year

Last year was difficult for the US tech sector, with the technology equity index down 33% over the 12 months. This fall is correlated with the Federal Reserve hiking interest rates to their highest levels in more than a decade, hitting growth companies, which tend to be more sensitive to rising rates.

Year to date

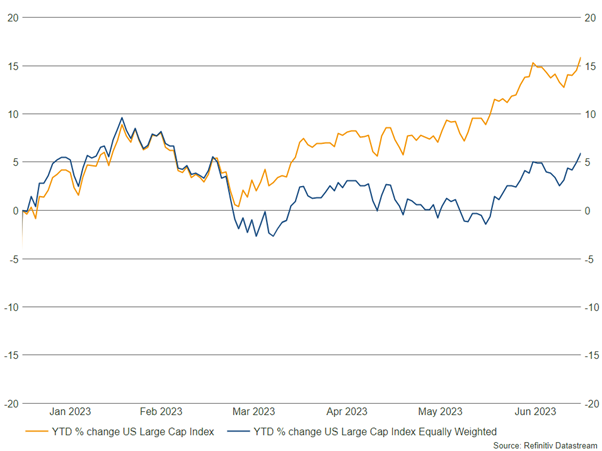

Despite recessionary concerns building last year, 2023 is yet to display signs of a market downturn in the US, notwithstanding the bankruptcy of Silicon Valley Bank in March and resultant concerns around the banking sector. American GDP is still growing, and large-cap equities are up nearly 16% in US dollar terms during the first half of the year. However, this number does not provide the full picture.

In a reversal of fortune from last year, it is again big technology firms that are driving US stock market returns. Within the index, seven stocks have underpinned performance year to date, those being Apple, Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia and Tesla. (We wrote about the rise of Nvidia recently.)

These seven stocks collectively represent 26% of the large-cap index, which otherwise is largely flat. Apple, which has a market capitalisation of c.$3 trillion, is up 49% year to date in US dollar terms. (Apple is worth more than the UK’s largest 100 listed companies put together.) Nvidia is still up 180% this year, and these large companies, in a market-cap weighted index, skew the headline performance. If we look at an equally weighted index, the overall returns fall as the size of the aforementioned stocks are less impactful.

Source: Refinitiv

As we have previously mentioned, artificial intelligence has been a key watchword and driver for markets this year, and the above chart indicates how deeply rooted these consumer-facing technology companies are in the long-term growth trend. Pricing power from the likes of Apple and Amazon, with vast, loyal customer bases, helps to bolster earnings and push the index higher.

Bowmore Portfolios

We have taken full advantage of the rally in US equities this year, via both active and passive holdings across all risk mandates. We are mindful of recessionary indicators suggesting we may see a downturn in the short to medium term. One key gauge, the spread between 10-year and 2-year US treasury yields, remains inverted. However, with a sensible allocation to broad US large companies this year, we have retained growth exposure that has provided positive returns for portfolios.