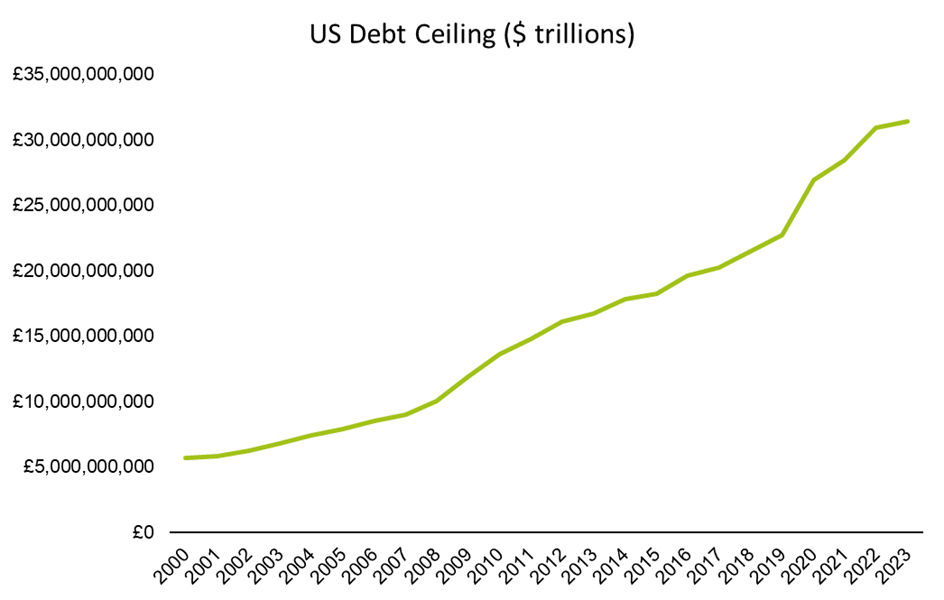

The US debt ceiling is the maximum amount of money the US government can borrow by issuing bonds. As the level of debt issued by the US government grows, the closer they get to running out of options and defaulting on their loans. As a result of this, the debt ceiling has been raised over the years since its introduction to avoid default, retain confidence and keep the establishment operational. With US government debt approaching $32tn, the time has come once again for ceiling raises to be negotiated within Congress.

Last week, Kevin McCarthy, the Republican speaker of the House of Representatives, detailed his plans for averting a crisis over the US debt ceiling, called the “Limit, Save, Grow Act of 2023”. The bill would allow a $1.5tn increase to the debt ceiling (pushing the risk of default back until 2024), which would be tied in with $4.5tn of budget cuts.

If a deal isn’t reached quickly, the US government could fall into default as soon as June, according to specialists.

Source: visualcapitalist.com

The bill

On Wednesday McCarthy called it a “clear plan for a responsible debt limit increase”. The bill scraps many of the green subsidies US president, Joseph Biden, has put into place, ends the student loan forgiveness programme and takes back unspent Covid-19 relief funds. The bill would also include a cap on government spending to 2022 levels and would repeal the Biden administration’s investment in the Internal Revenue Service (IRS). The legislation includes a lengthy list of Republican priorities that the Democrats will definitely reject.

Passing the law

Any legislation to raise the debt ceiling would need to be approved by both chambers of Congress and signed by Joe Biden. While Republicans control the House of Representatives, Democrats still hold the Senate, the upper chamber.

On Wednesday, the House of Representatives held a closely contested vote (217 vs 215), which approved the plan, giving a clear victory to Kevin McCarthy. The reality, however, is that the bill will not hold much support in the Senate since it’s controlled by the Democrats. Furthermore, Biden has already vowed to veto the measure if it miraculously gets to his desk. Even Republicans have admitted that this bill is realistically heading nowhere. This said, by passing the bill in the House, Republicans see this as a crucial step to strengthen their position, claiming the vote will help force the incumbent administration to come to the negotiating table.

Economic impact

The US Congressional Budget Office announced that McCarthy’s plan would cut deficits by $4.8tn over the next 10 years. However, Moody’s Analytics on Monday released estimates showing that if Mr Biden, in an attempt to avert a default, agrees to all those demands, the US economy would move into recession in 2024 and would cost approximately 2.6 million jobs. Moody’s also states that the only real option is for both parties to come to terms and increase the debt limit in a timely way. There is still time, and it is in the interest of both parties to come to an agreement.

Despite the debt ceiling grabbing more column inches recently, there is an expectation that a deal will be reached, and investors are more focused on US growth and inflation announcements, which will set the scene for sentiment and interest rate expectations over the coming months. This said, we are still seeing historically high yields for short term US treasury notes (US government debt), indicating a cautious tone from bond investors. Three-month treasuries currently pay around 5.15% and continue to exceed the levels of income paid on long-term treasuries. Whilst this points towards a contraction, US inflation is on a downward trajectory, unemployment is still low and growth remains in the low single digits.

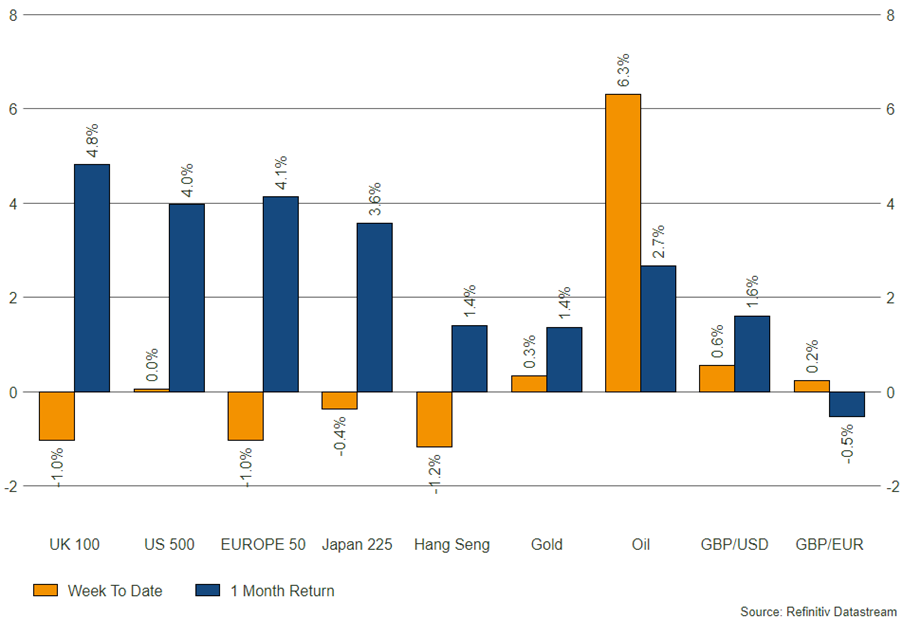

Source: Refinitiv – market data as at 27/04/2023