- US credit rating downgraded to AA+ by Fitch.

- Fitch gives government debt backdrop and fiscal management rationale.

- Treasury secretary, Janet Yellen, describes treasuries as “safe and liquid”.

Last week, the credit rating of the US was downgraded by Fitch, one of the three main ratings agencies, from their best score of AAA, to AA+. This suggests the creditworthiness of the US government has deteriorated, and that US treasuries are more risky than other, higher rated debt. This was a move that raised eyebrows, though some commentators would argue the signs were there.

Reasons for the downgrade

The rating downgrade reflects Fitch’s anticipated fiscal deterioration in the US over the next few years. Fitch expects the US government deficit to rise to 6.3% of GDP in 2023, and 6.6% in 2024. The larger deficit will be driven by weaker growth in the coming years, with the debt to GDP ratio projected to rise to 118% by 2024. By comparison, the median debt to GDP ratio for a AAA rated country is 39.3%. Additionally, the repetition of last-minute agreements regarding the US debt-ceiling have eroded their confidence in US fiscal management.

Higher interest rates exacerbate the interest burden of government debt, while an aging population, with increased healthcare costs, will raise government spending. With tighter credit conditions, Fitch projects a slowdown in consumption in the US.

Janet Yellen, US treasury secretary, highly disagreed with Fitch’s downgrade, stating “Fitch’s decision does not change what Americans, investors, and people all around the world already know: that treasury securities remain the world’s preeminent safe and liquid asset”.

Market impact

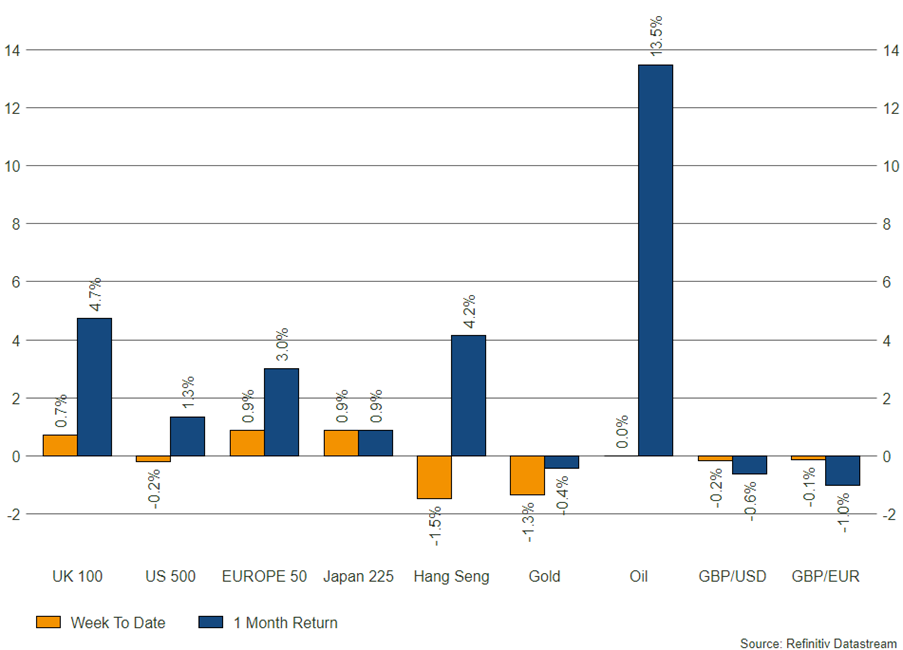

US equities have fallen 2.8% this month, with treasury yields rising 3.2%. Whilst only Moody’s now gives the US their top rating, we believe the reaction from markets will be short lived, with US government debt playing the same role for global investors going forward. The US treasury market amounts to a total debt pile of $32 trillion. Of the 100+ countries that Fitch provides ratings for, only 10 hold a AAA rating, the combined government debt markets for which are just over half the size of the US. An exodus to “less risky” sovereign debt is unlikely across the board.

Bowmore portfolios

We do not hold direct treasury exposure in portfolios, though some of our selected fund managers will leverage these securities for liquidity and risk management. To echo Yellen’s comments, what matters is that US treasuries are government-guaranteed and that investors trust this guarantee. That trust is not eroded over night by a rating change, but does highlight some of the challenges ahead for the US government and economy. Whilst we have taken some profits from our US equity exposure this summer, we believe that interest rates are close to peak in the US. As and when rates meaningfully pause and/or start to fall, this will be supportive for risk assets and growth.