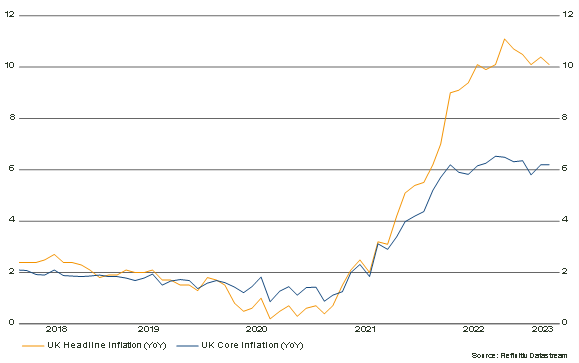

Official figures released on Wednesday showed that the UK’s headline inflation rate is falling less than expected and remains in double digit territory, at 10.1%. In parallel, Eurozone inflation fell sharply to 6.9%, and the US dropped to 5.0% in the same month.

Source: Refinitiv

Headline inflation represents the growth of prices across the board, including highly volatile prices, such as food and energy. However, the sensitive nature of these aspects of the economy can distort the overall picture, and so core inflation is used to strip away this volatility.

Headline inflation

The British Prime Minister, Rishi Sunak, made a pledge at the beginning of 2023 to halve headline inflation by the end of the year, and whilst this may seem a tall order with inflation remaining so sticky, many economists believe this to be a fair target. By summer, gas and electricity prices are expected to fall, with commentators predicting that gas prices will fall by as much as 85% since they peaked last August. Currently, energy prices contribute to 3.5% to the 10.1% headline rate.

In the US, energy contribution to annual inflation turned negative in March, reducing headline inflation by 0.5% to 5.0% overall. Energy costs are now 35% below their June 2022 peak.

Core inflation

With volatile prices being stripped away, core inflation across developed markets has been largely consistent. In the UK it came in at 6.2% for March, not moving from February, whilst the Eurozone and US picked up 0.1% each, reading at 5.7% and 5.6% respectively. The UK’s gap to its peers on this measure is clearly less stark and provides some reassurance that the underlying economy is not running away from the global trend. This said, inflation is still too high across the board when considering central banking targets of around 2%.

The outlook for UK interest rates

A major consideration for UK policy setters is wage growth, which currently sits above pre-pandemic levels, something that Bank of England (BoE) governor, Andrew Bailey, has commented on more than once. Financial markets are currently pricing in a further three 0.25% rate rises in the UK this year, as the central bank attempts to put additional brakes on inflation; a view that has become more aggressive in the last week. It comes at a time where the rising cost of living is pinching consumers from both sides, with higher prices and higher rates adding to recessionary pressures.

However, the monthly reading for year-on-year GDP growth in the UK was at 0.5% in February, staying within modest but positive territory, and unemployment remains low. For now, it seems as though the economy is holding up. If energy prices continue to fall and relieve some stress on household budgets, this will be a positive for headlines and wallets.

Bowmore portfolios

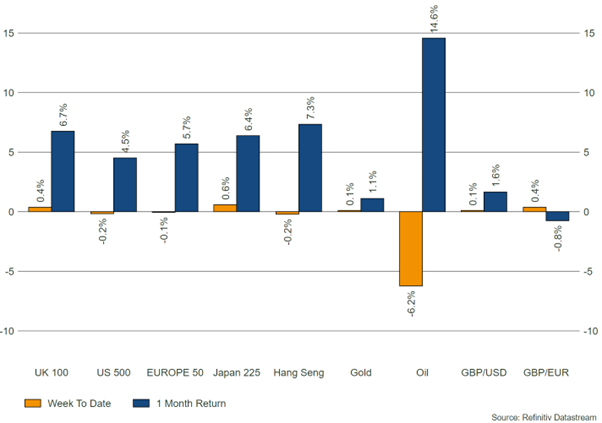

Although there are challenges ahead for the UK economy, domestic markets have held up relatively well over the last 18 months. Due to the makeup of the companies in the space, higher energy prices and interest rates have stood major UK benchmarks in good stead when compared to global growth trends that have struggled to justify lofty valuations in the face of higher rates. Whilst we saw this unwind a little in February when concerns for the banking sector emerged, UK equities have contributed well this year.

Our allocations to large, quality companies have yielded mid-single digit returns year to date, with the Artemis UK Select fund leading the way, up 11.0% over the period. Whilst we remain vigilant that conditions can change quickly, experienced teams have shown they can provide strong performance through active management.

Source: Refinitiv – market data as at 20/04/2023