Key takeaways

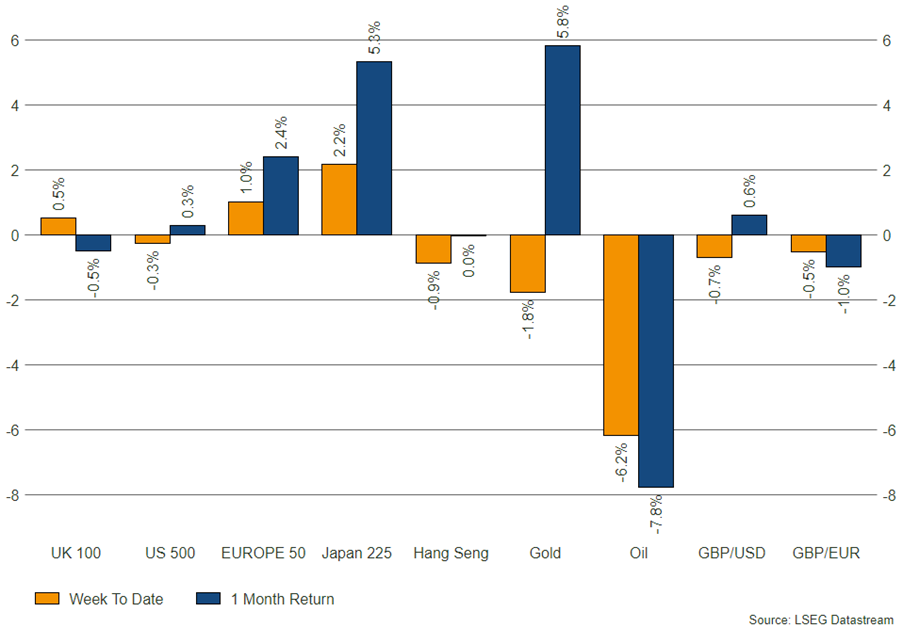

- Equity markets up 4.0% month-to-date on peak interest rate rhetoric.

- Bond prices at depressed levels due to tighter monetary policy over last two years.

- Attractive opportunity for longer-dated bonds to appreciate when rates are cut.

The pivot opportunity

With the UK, US and European central banks all holding interest rates steady in their most recent policy meetings, investors have allowed themselves some positive reflection after a tricky couple of months for markets. Global equities were off 4.5% in September, and a further 3.0% in October, but have rebounded this month, with the global index up 4.0% month-to-date in US dollar terms.

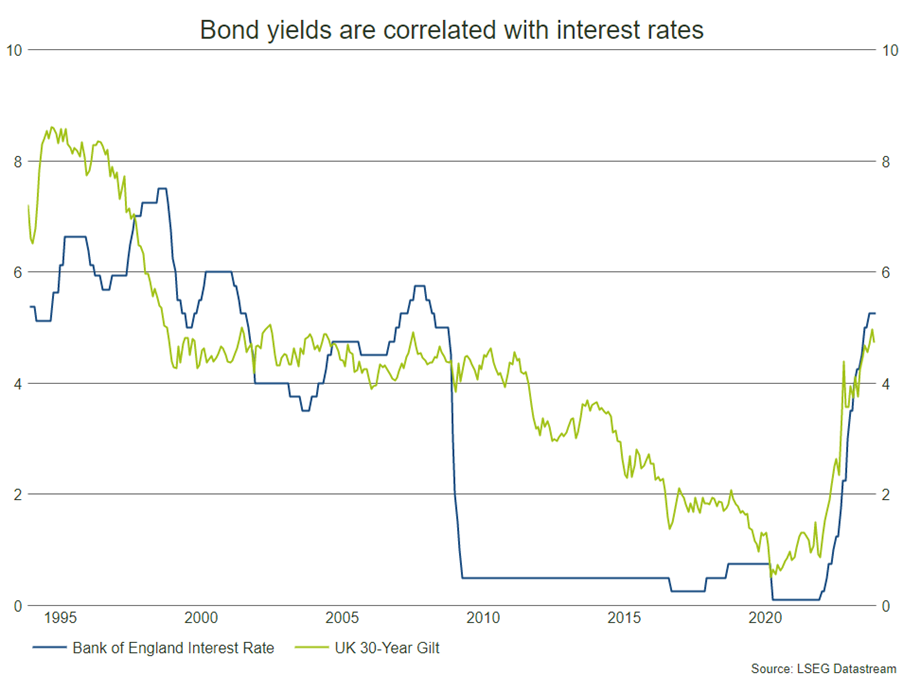

This uplift in markets is reflective of the growing belief that we have either reached, or will very soon reach, peak interest rates in developed economies. With peak rates comes the prospect of rate cuts further down the line – though central banks have been clear that they feel ‘higher for longer’ will be required – and when interest rates are cut, bond prices tend to rise, with longer-dated bonds usually exhibiting this relationship more acutely. The faster rates are cut, the more price appreciation can be expected.

As we have written in past notes, rising interest rates over the last two years have had the opposite effect on bond prices, with values being pushed lower and yields ballooning to levels we have not seen in more than a decade. Thirty-year UK gilts have been yielding well over 4% since May, and at one point broke 5%. When yields rise prices fall, and this presents an opportunity for investors to buy into these markets at attractive points in anticipation of a pivot in monetary policy.

Bowmore portfolios

We have recently slightly increased our exposure to UK government bonds, bringing in a long-dated gilt that offers the upside potential described above. When interest rates are cut in the UK, longer-dated bond prices are positioned to rally. In the interim, buying in at a lower price means the income paid to investors represents a healthy yield. We have kept this allocation modest for now, as volatility in this sector tends to be higher due to interest rate sensitivity.