Key takeaways

• Global equities outperform cash by 142% since 2000 in sterling terms

• Easy access cash ISA rates up to 4%

• Cash returns are eroded by inflation, which remains elevated for now

With the UK base rate hitting 5% this month, returns on cash savings are turning heads for some investors. We have mentioned in recent notes that savings rates have been on the rise, with easy access cash ISAs reaching 4%; however, is there an opportunity cost to holding cash-only investments?

The numbers

When we run the numbers, history tells us that cash deposits have not kept pace with the returns generated by global equities over the long term, even if that cash is invested in the equity market at the worst possible moments.

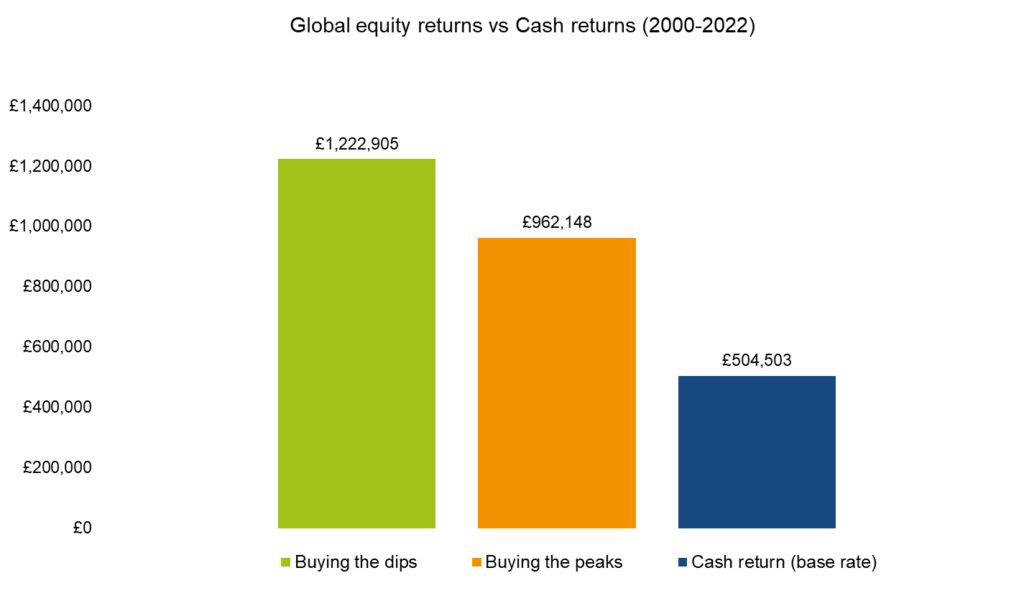

In the chart below, we see three separate scenarios when investing the current ISA contribution of £20,000 on an annual basis at different points in each calendar year (since 2000):

• Buying the dips: cash invested on the most favourable day in each calendar year, when global equities reached their lowest point, in sterling terms.

• Buying the peaks: cash invested on the least favourable day in each calendar year, when global equities reached their highest point, in sterling terms.

• A regular £20,000 cash saving is made at the start of each calendar year.

Source: Morningstar

Over the period 2000-2022, an investor would enjoy almost double the returns on cash when investing a regular annual contribution of £20,000 at the worst time each year in global equities. This rises to 2.4x if lucky enough to time contributions at the lowest point for global equities each year.

The compromise

Over the long term, it is reasonable to expect equity markets to produce higher returns than cash deposits, though the journey may be bumpier. This is due to the trade-off between risk and return.

By investing in financial markets, capital is subject to greater risks than if it were kept on deposit at the bank and in the case of equities there is no guarantee of return. The scale of the ‘risk premium’ determines how investors need to be compensated for accepting market, liquidity and default risks, by way of a higher rate of return.

Bowmore portfolios

Our approach to portfolios is less severe, knowing full well it is not possible to time the equity market to such an extent, and realising that cash plays an important part of asset allocation. It can dampen volatility at times of market stress, while providing liquidity that allows us to act when opportunities arise. In addition, now that cash rates are higher, these positions can also contribute to portfolio performance.

In recent years, our cash allocation has at times been above typical levels to help manage the volatility witnessed in markets. However, the above study serves to highlight the importance that risk allocations play in generating long term returns.

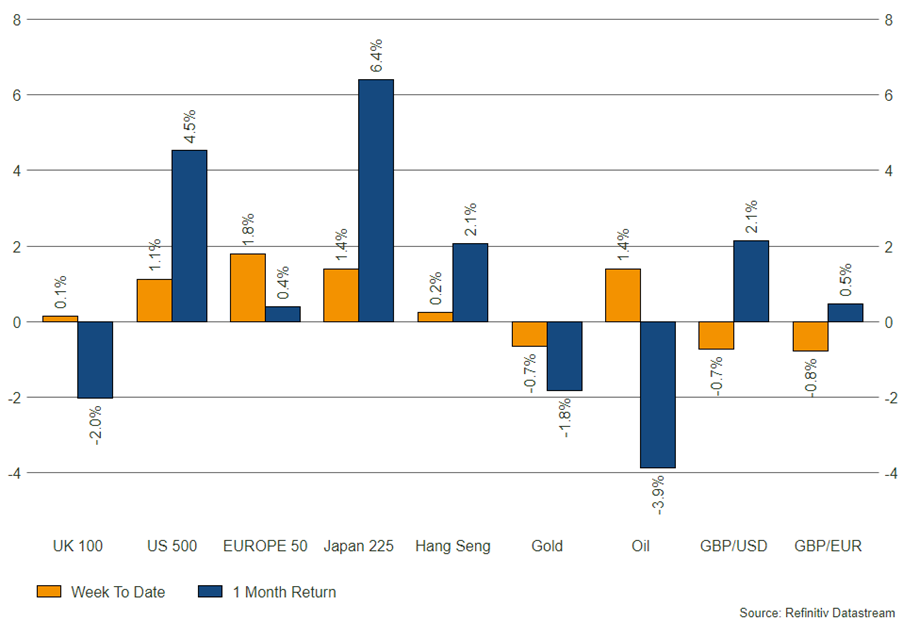

Source: Refinitiv – Market returns as at 29/06/2023