- Russian Growth of 2.6% outpaces that of G7 countries, with c.RUB9 trillion in energy revenues. A 25% decline from the peak last year, but above the 10 year average.

- Russia is spending RUB 14 trillion on the war effort and bereavement payments, which is a threefold increase since 2021.

- The so-called Grey Market is flourishing with little power of western governments to stop this.

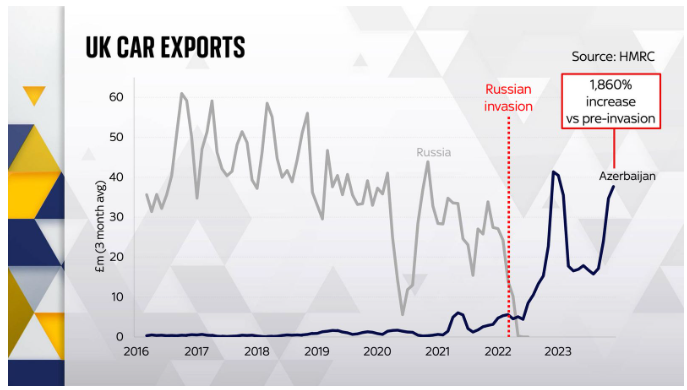

- UK car exports to Azerbaijan have increased 1,860% over the five years ahead of the invasion according to HMRC trade data.

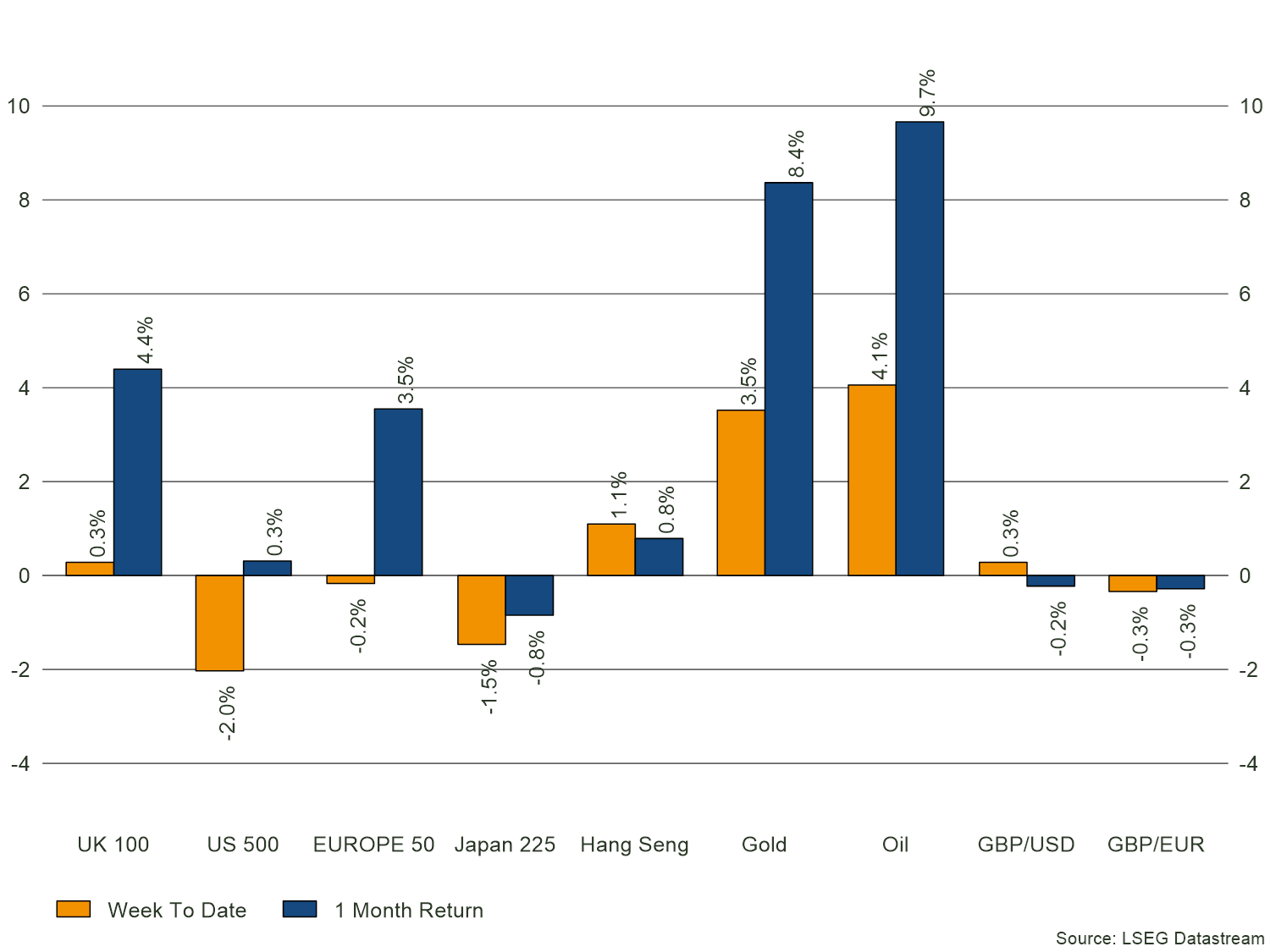

Last month the IMF increased its GDP growth forecast for Russia to 2.6% this year, a big jump from the 1.1% it had been predicting last October, and a rate that outpaces the G7, but the key question is can this continue. In the short-term energy revenues are holding up (see chart 1) and given the significant ramp up in military spending, short-term inflation is spiking and a camouflage has been thrown over the economy.

Outside of the rampant war machine things are not looking so bright with car production down by a third and the Russian Aviation industry being propped up with $12 billion of support due to sanctions. Russia is now turning to build Russian grown planes in a clear sign that sanctions are biting under the exterior. There were 180 reported aviation accidents in Russia last year, up from 60 in 2022, so the ongoing maintenance of these aircraft looks set to remain a problem for Russia moving forward.

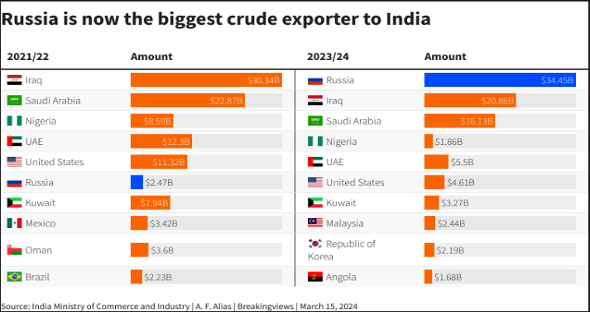

The Russia War machine is being funded by these energy revenues and with the threefold increase in ‘war’ spending it is little surprise that growth and inflation are evident in the region. It also highlights that sanctions are less effective in key areas than western governments would have liked. If you look at the oil exports in the chart above, Russia is simply supplying other nations directly but in fact continues to supply oil globally. Western governments in turn are buying more from countries that they did not previously buy from. In other words, oil demand and production remain largely unaffected by the Ukraine war.

Sanctions are proving limited as they are in practice only limited in scope and they are not global. A little under half the European exports to Russia are not covered by sanctions and India & China do not recognise them, with Chinese imports to Russia increasing by 64% ($240billion) since 2021. Imports of goods like cars and electronics have doubled since 2021. Turkey, India and the UAE have also helped Russia evade sanctions by exporting to Russia high end technology and other products.

Are the Russian oligarchs and wealthy also affected? The so-called Grey market.

It would appear they are not.

It seems as though the so-called grey market is thriving due to the close boarder proximity of countries like Azerbaijan. Customs enforcement is weak and demand in Russia remains high for such luxuries amongst the wealthy. Sky News did some work in this area and found that £273 million pounds of cars were sent to Azerbaijan last year, whilst direct shipments to Russia have fallen to zero. The exports of cars overall to Azerbaijan has increased 1,860% when compared with the five-year pre-invasion as per the HMRC trade data.

While the HMRC data does not identify specific carmakers or consignments, it does show that the port most used for this UK trade was the Port of Bristol, which had never previously exported more than a few million pounds worth of goods each year to Azerbaijan. In the two years following the invasion it saw those exports shoot up to more than £100m a year. The wider Grey market evidence in Russia sees a total of $6billion of parallel imports into Russia over 3 months from May to July 2023, giving access to high end cars, smart phones and other premium western brands to those in Russia who have the money to buy them even at the elevated prices they now command.

Conclusion

Russia was prepared for sanctions. They have tight capital controls, interest rates were increased significantly, along with exchange rate and capital controls that ensure foreign currency is deposited with the central bank to make up for those frozen as part of the sanctions. German exports to Russia have plunged, but exports to transit countries such as Kazakhstan, Armenia and Kyrgyzstan have mysteriously rocketed. “Britain, shamefully, is the biggest insurer of Russia’s international oil trade, to the tune of more than £100bn in the first 18 months of the war.”* The firms concerned are doing nothing illegal: our government allows them to rely on “attestations” that the cargoes comply with the G7’s price cap. Meanwhile, Russia is still importing millions of dollars’ worth of nitrocellulose, vital in making ammunition, from Nato countries and their partners. Ultimately, the west needs to decide what is more important. On one hand they need the revenue and on the other the defence of Ukraine. While there is little doubt that Russian sanctions have had some impact on specific areas of the Russian economy and political landscape, their overall effectiveness in achieving their desired goals remains subject to debate. Sanctions alone may not be sufficient to induce the desired changes in Russian behaviour, and a comprehensive strategy that combines diplomatic, economic, and other measures may be necessary to address complex geopolitical challenges.

*Edward Lucas, The Times.