A seed of stabilisation?

- The Chinese have lost c.$6trn in value over the last three years – twice Britain’s economic output

- The property sector accounts for a quarter of China’s GDP, and transaction volumes are still declining

- Chinese domestic savings at a percentage of GDP is nearly 50% compared to the UK’s 17.15%

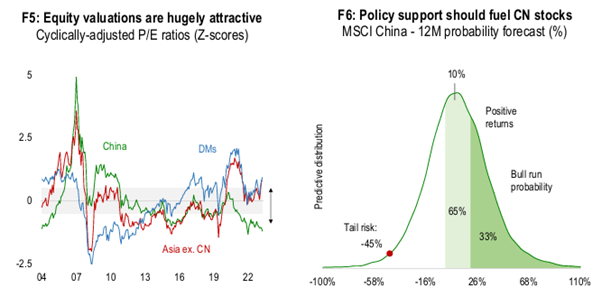

Since February 2021, Chinese equities have fared poorly. Back in 2021 this was due to regulatory pressure on property developers and technology companies, but more recently this has been due to weak cyclical conditions, strict COVID lockdowns and a global shift in sentiment towards near-shoring. Consumer and business confidence is at historical lows which has signalled Beijing to start taking actions to improve sentiment.

Though cheap valuations are no guarantee of strong returns, they generally improve expected gains and historically this has meant c.23% upside in the following 12 months. This performance is only higher if accompanied by strong economic growth. For a continuous rally in the longer term however, investors would require China to sustain a rapid pace of growth.

Source: Numera Analytics

Factors at play

- Local authorities have become debt-ridden as the property sector crisis has forced a slow down of land selling. This is currently down c.13% from last year and at its lowest level since 2017

- China officially ended their zero COVID policy in January 2023, some eighteen months after the UK. This prolonged lockdown along with other factors caused huge disruption to supply chains globally, reminding many businesses just how reliant they had become on other countries for goods and services

- The Chinese consumer emerged from lockdown reluctant to spend, possibly due to the ongoing property crisis’s negative wealth effect and domestic demand only c.70% of the pre-COVID equivalent

- Tensions between US and China have meant that investors have meaningfully reduced exposure

- China’s economy grew 5.2% in 2023 and though that may seem impressive for a major economy, it’s far below the double digit growth that China has been accustomed to in the last decade

- While the US, UK and other countries governments stepped in to support their economies over the last few difficult years, Beijing’s approach has been more piecemeal and has fallen short of expectations. To restore confidence, investors want to see a government backstop to support property developers

- Demographics are unfavourable compared with other emerging economies, with twice as many people turning 60 each year than being born

Support from Beijing

With the property crisis, stock market rout and debt woes ongoing, Beijing has stepped in with supportive policies in the hope of achieving this year’s 5% GDP growth target and to increase confidence. These measures include:

- General public expenditure jumped 14% on the year in January and February, the fastest pace for 5 years

- A cut to the reserve requirements ratio (RRR) by 50 basis points, and indication that another may follow

- Issuance of 1 trillion yuan ($139 billion) of ultra-long special central government bonds planned this year

- Giving real estate developers leeway to use their property-backed loans to repay other loans, and not just for property investment

Bowmore portfolios

While we hold a modest allocation to small-cap Chinese equity within the core mandate, our emerging market exposure also actively allocates to the region. On the whole, China has undoubtedly had a tough few years, but more recently we’ve seen green some green shoots emerging as consumer and business confidence begins to recover from rock bottom.

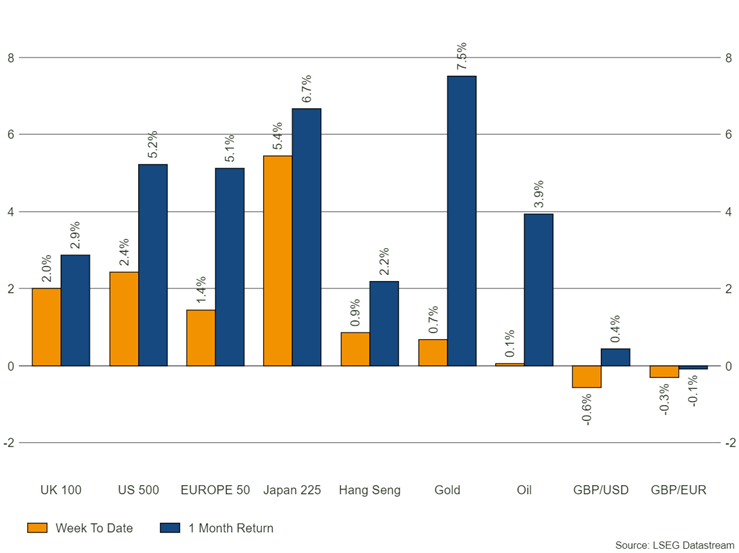

The region undoubtedly remains risky and with several sizable challenges ahead, but the announced support policies and strength of consumers in terms of average savings may mark the beginning of an idea that fortunes may be changing, and which brought about 2.6% performance in the last 30 days.