French elections

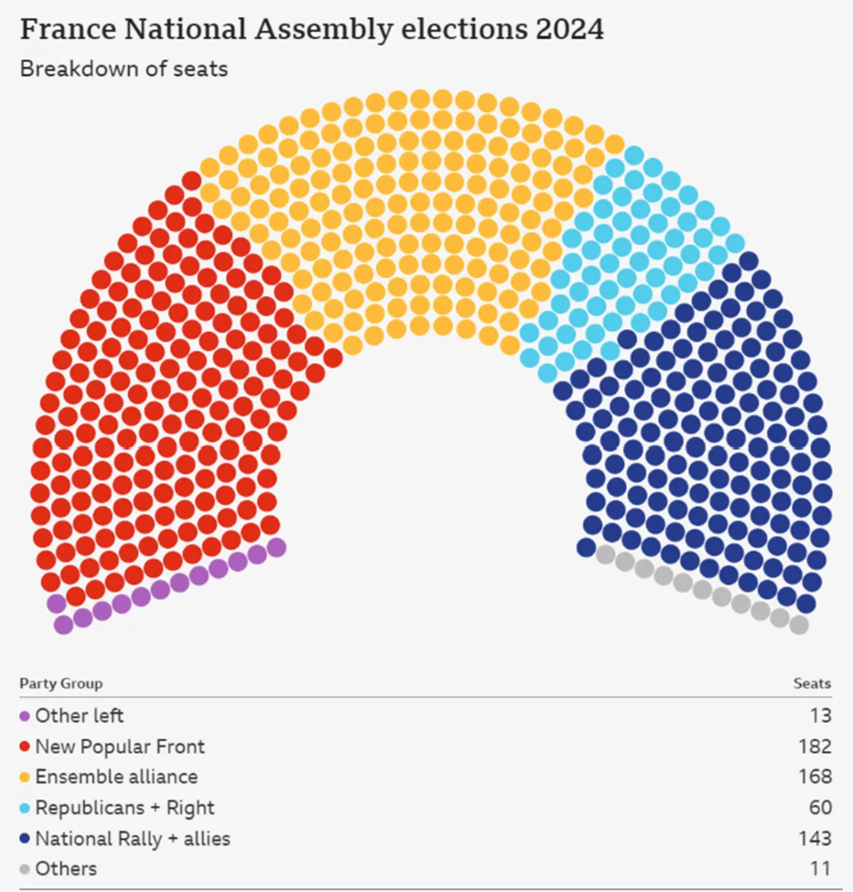

- Following the second round of the French election on Sunday 7 July, they now have a hung parliament.

- More than 200 candidates dropped out of three-way races to block the far-right winning a majority.

- France’s hefty budget deficit of 5.5% of GDP, which the outgoing government was aiming to reduce to 3%, is now unlikely to be addressed.

Last week, we focused on the UK election, it’s implication for markets (or lack thereof) and the government’s budget deficit. With the UK government’s limited spending power and Labour’s desire to stay within these self-imposed constraints, the UK is facing a period of political stability, even as ‘change’ gets underway. The same cannot be said across the Channel. It’s been just over a month since French President, Macron, called the snap election to reestablish his authority and set off a political earthquake in France. These events culminated on Sunday 7 July, days after the UK election, with a shock election result that has left France with a hung parliament.

What happened in the voting?

France has two rounds to their voting, whereby the top 2 candidates (plus any that get 12.5% or more of the vote) go through to the second round and everybody votes again. In the first round, Marine Le Pen’s far right party, National Rally (RN), won the largest share of the vote at 33% for the first time ever. This caused a great deal of concern both in France and across the EU as Le Pen has talked about France leaving the EU before in a, rather familiar, ‘Frexit’ deal. The other parties, namely, the centrist party, Ensemble, and their rival left party, New Popular Front, rallied together and called for their candidates to drop out from three-way races with RN to avoid splitting the vote.

It’s not the first time that we’ve seen French parties rally together to form a front and block the far right from getting in. It happened in 2002 with Chirac against Jean-Marie Le Pen (who founded RN) where all the party leaders called upon their parties to vote against Le Pen in the second round and it was a complete landslide victory for Chirac. Similarly, in 2017 when Marine Le Pen made it to the second round, the majority of other parties rallied behind Macron and he won convincingly 66% to 34%. This time, more than 200 candidates pulled out of three-way races with a RN candidate which meant a RN majority looked unlikely. In the end, New Popular Front won, whilst RN dropped down to third. However, no party won a majority and France now have a hung parliament.

What are the market implications?

It would be remiss for an Investment Manager to talk about politics and not the impact on financial markets. France have a burgeoning debt problem with their budget deficit standing at 5.5% of GDP last year, more than double what it was 5 years ago (2.4%). Whilst the outgoing government planned to get this down to 3% by 2027, the new hung parliament is less likely and less able to reduce this deficit. Both NFP and RN want to increase spending, despite EU budget rules. Thankfully neither party won a majority and will be able to drastically loosen fiscal policy, but debt ratios are still likely to rise. These debt problems have seen French Government Bond spreads widen, resulting in Bond prices falling.

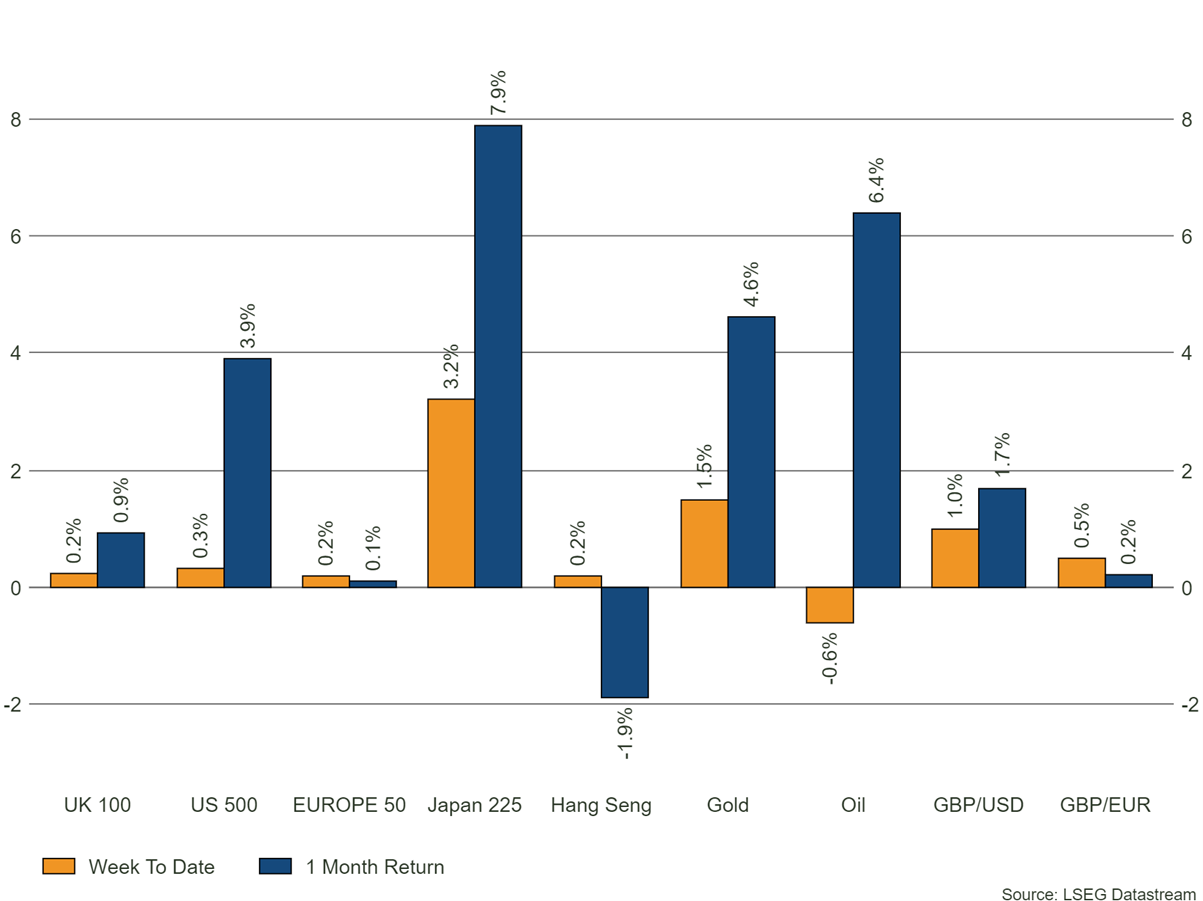

On the equity front, France has quite a high concentration of consumer discretionary names, think LVMH, Hermes, Kering which may struggle as the cost of living and higher rates begin to take a toll on consumer demand, particularly with the government being unable to support from a fiscal standpoint now. The Euro zone more generally though has a lot of high quality companies trading on a significant discount to their US rivals so there is definitely value to be found. This value may be realised sooner rather than later as economic activity in the US begins to moderate and investors start to look elsewhere. The French equity market has been unsurprisingly volatile the past month and, whilst it rallied strongly before the second round as RN’s majority looked unlikely, it slid again at the result of a hung parliament.

Bowmore Portfolios

We expect France’s government bond spreads to continue to widen (and prices to fall) as a result of a hung parliament. It will come as no surprise that we have zero exposure to French government debt and our French Equity exposure is also very low at less than 2%. In total our Risk 5 portfolio has 12% of its Equity allocation in Europe ex UK, with larger allocations to Switzerland and Netherlands.