Key takeaways

- Japanese government to introduce $113 billion fiscal package.

- Tax cuts, subsidies and payouts make up plans.

- 1% drop in inflation and 1.2% pickup in growth expected.

Japan’s fiscal package

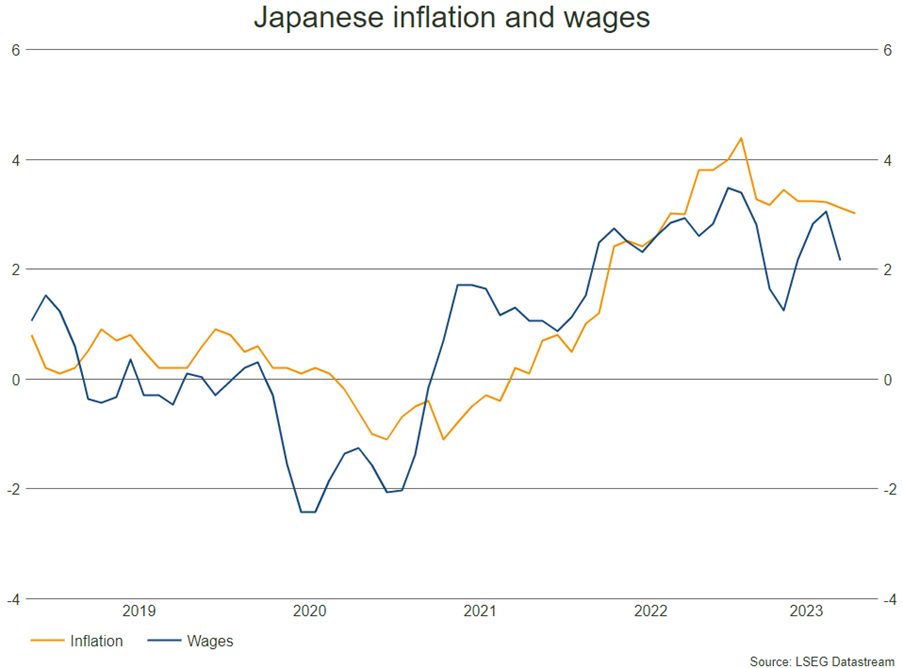

On Thursday this week the Japanese government announced plans to implement a $113 billion fiscal package intended to ease the pain inflicted on consumers by higher inflation. Amongst the plans are temporary income tax cuts, subsidies to gasoline and utility bills (not dissimilar to what we have seen in the UK), and payouts to low-income households.

Whilst some have suggested that stimulus like this could be inflationary and boost demand, it is expected the effect of the subsidies will lower inflation by 1% in the first half of next year. It’s also expected that economic growth in Japan will receive a boost to the tune of 1.2%, based on government estimates, though other estimates place this figure much lower, at around 0.2%.

Prime Minister, Fumio Kishida, said that through the list of measures he hoped to create a condition where the pace of income growth outstrips the pace of inflation by boosting companies’ revenue and profitability.

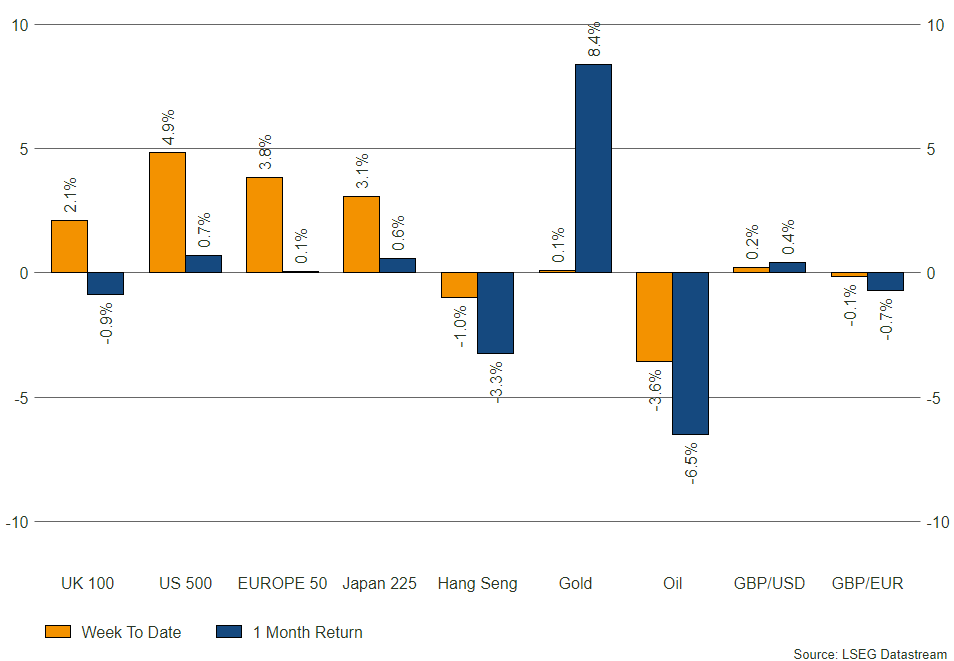

Bowmore portfolios

Portfolios have been the benefactor of positive performance in Japanese equity markets year to date. We wrote earlier this year that a weaker yen, resurgent tourism, and improved corporate governance has seen Japanese markets buoyed. Over the last 11 months our allocated Japanese equity funds have added 12.0% and 9.6%, at a time where global equities have risen 7.6% in sterling terms.

Having repositioned our exposure to core and value stocks in Japan back in July, the strains felt by growth sectors as a result of higher inflation have been less pronounced. With inflation remaining above the country’s 2% target, and the prospect of tighter monetary policy to come, we feel this positioning is sensible to retain for now.