- The latest Japanese exports figure has risen by 5.4% YoY

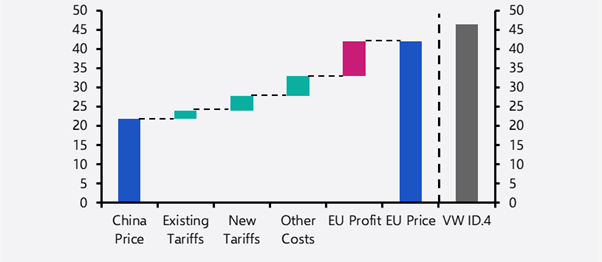

- New EU tariffs on Chinese EV’s can now reach up to 48% of the cars value

- Japan’s automotive production industry is valued at c. 20 trillion Yen, or 3% of their GDP

The opportunity for Japanese car manufacturers has never been better in terms of potential for expansion into the US and Europe, benefiting from elevated security concerns and wide-sprawling protectionist policies.

While Japanese automakers haven’t led the EV race for more than ten years, they have dominated hybrids – and in many cases, plan to put that profit toward realising their ambitious EV goals. Toyota, for example, are targeting to manufacture 3.5m EVs a year across dozens of models by 2030. To put that in perspective, Tesla sold c.1.8m cars last year. In the nearer term, by 2027, Toyota plans to introduce new solid-state batteries to improve charging time and travel range – making EVs more attractive to buyers.

Protectionist policies

Following the rise in US tariffs on Chinese EV’s – now at 100% – the EU announced that EVs imported from China will be subject to an additional charge of up to 38%, on top of the 10% tariff already in place.

Although a 48% tariff might sound as though it’d render the product uncompetitive vs local rivals – the EU isn’t aiming to eradicate their affordability entirely, perhaps they are simply looking to even the playing field towards their domestic market equivalents. Anyhow, imports have been negatively affected and only 440,000 Chinese EVs were bought (€9bn) within the EU last year (c. 4% of the EU’s household expenditure on cars).

North America’s anti-Chinese EV sentiment extends to their neighbours, with Mexico reportedly ceasing to offer tax or cheap land incentives for Chinese manufacturers and Canada preferring to strike a deal with Honda to open four EV related factories, offering them up to $5 bn in subsidies. Needless to say, there seems to be a head start for businesses based out of countries that are aligned with the US politically.

Cost break down and price of BYD’s Seal U vs Volkswagen (VW) in Germany

Source: Capital Economics

Japanese labour

The Japanese workforce is one of the best educated globally with c.79% having completed advanced studies and there are tentative signs that it is becoming more dynamic. The career intentions of new hires have broadly shifted over the past ten years, challenging the cultural norm of working within the same company (and industry) across an entire career. The sheer number of start-ups registering (up 25% in three years) means there are more opportunities for mobility as well as increased entrepreneurism. Furthermore, given the ongoing success with hybrid vehicles in the region, a relatively new technology, availability of skilled labour is seemingly not a limiting factor.

Bowmore portfolios

We rotated our exposure within Japanese equities towards value style investing in late 2022, namely towards the MAN GLG Japan Core Alpha proposition, given valuations in the region were trading at attractively depressed levels and they were beginning to experience inflation for the first time in over 25 years.

The fund adopts a contrarian approach, meaning it tends to invest in undervalued companies that are temporarily out of market favour. Their philosophy is based on the belief that market inefficiencies can offer buying opportunities and have recently pivoted towards consumer cyclicals for example Nissan Motor, pursuing gains from a domestic reinflation story. The fund has returned 30.4% since purchase.