Key takeaways

- Germany registers third consecutive quarter of zero or negative growth.

- An aging workforce, trading partners and competition will pose challenges to the economy.

- European equities are up 7.5% over 12 months.

Europe’s largest economy, Germany is typically billed as the economic powerhouse within the bloc. Germany’s influence on finance and politics within the EU is well documented; however, more recently growth has been harder to come by. Last week, Germany reported flat quarterly GDP growth, (the third consecutive reading at or below zero) and has had two quarters of negative year-on-year (YoY) growth. The International Monetary Fund (IMF) now estimates that Germany will grow slower than the US, France, Britain and Spain over the next five years.

The challenges

Germany will be confronted with a number of challenges over the coming years, including trading with China, industry competition, an aging workforce and questions over how to meet net-zero emissions.

The German economy has the highest export rates to China of any other European nation. With China stagnating over the course of Covid, Germany has felt this slow down. Additionally, both America and Europe want to become less reliant on China and diversify trading partners, which will take time.

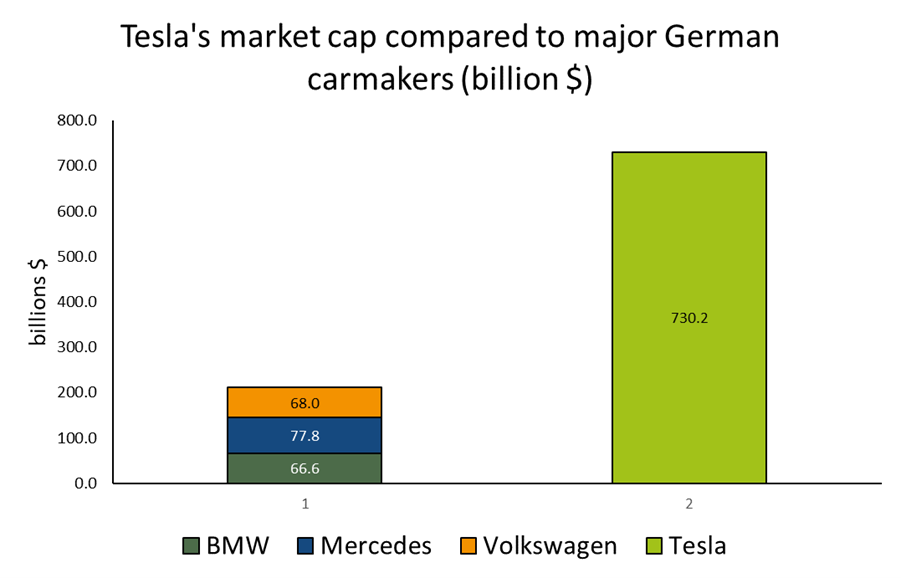

One of Germany’s flagship industries is the making of cars; however, an explosion in the electric vehicle market creates competition for this segment of the economy. To illustrate this point, the combined market capitalisations of BMW, Mercedes and VW, three of the most famous German carmakers is now just c.29% of Tesla’s overall market cap (in US dollar terms). These same brands are also facing growing competition from China.

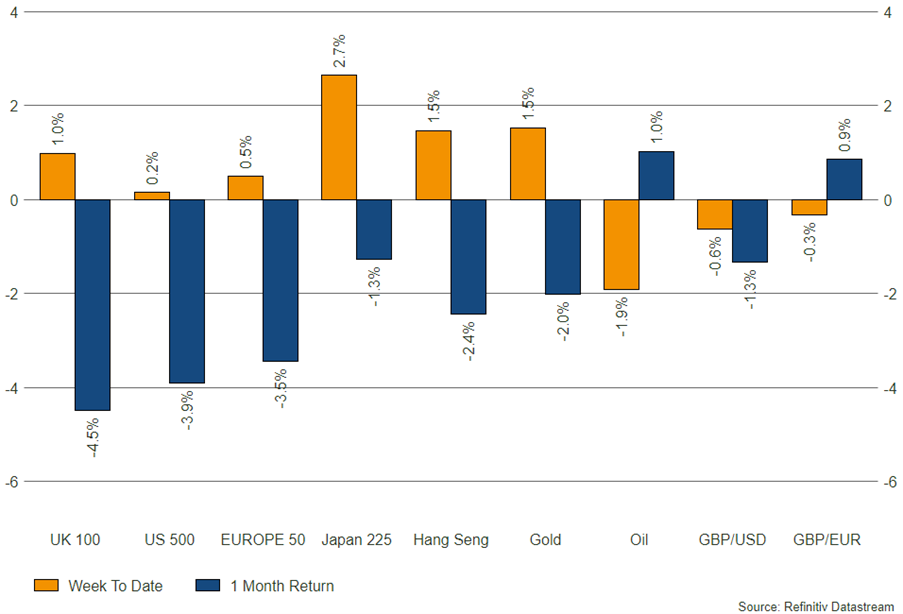

Source: Refinitiv

Lastly, Germany is becoming an older country. Its working age population is around 64% of the total, which is similar to the US. However, its median age is around 45, compared to 39 in the US, meaning that a higher proportion of workers are closer to retirement. These people leaving the labour force will become harder to replace as the population ages and fewer participate in working. A greater reliance on immigration may be the way to plug these gaps.

Despite these challenges, not all metrics are negative. Unemployment is currently at 3%, inflation is falling, and the country is one of the richest in the world, with strong industries and trading partners. As economic leaders in Europe, Germany has the power to influence its future.

Bowmore portfolios

Broad European equities are up 7.5% over the last 12 months, with German equities rising 13.5% over the same period. We hold European equity allocations across our core and ESG mandates, with our selected active managers returning 10.2% and 14.1% over the last year. Whilst the region comes with its obstacles, the blend of industries and companies within Germany and Europe have offered investors an alternative to the big tech or growth trends we saw for so long in the likes of the US.

Source: Refinitiv – Market returns as at 24/08/2023