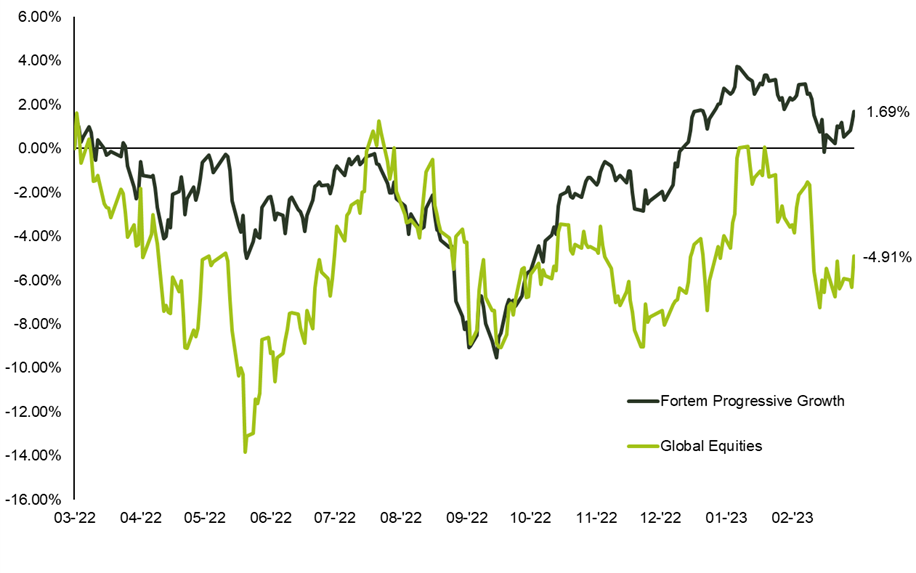

As market volatility has been elevated over the last 18 months, it is important for us to provide balanced exposure in the portfolios we manage and diversify returns. One way we do this is through an allocation to structured products. Put simply, this offers exposure to major equity markets, whilst providing some downside protection over the long term.

One of the structured product funds we allocate to, the Fortem Progressive Growth fund, has done this well, returning +1.7% over the last year, with global equities off -4.9%, both in sterling terms.

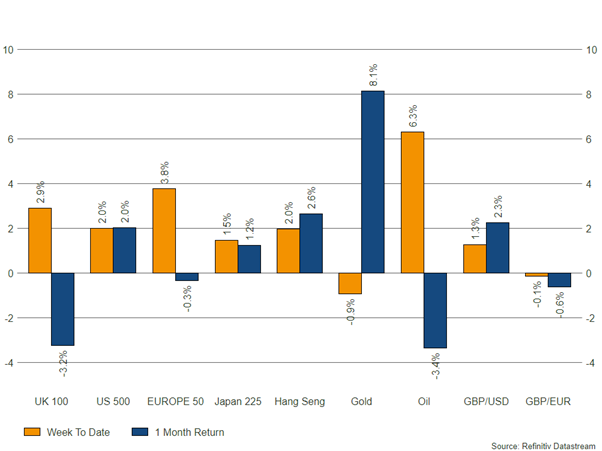

Source: Refinitiv

What are structured products?

Structured products are a debt and equity-based investment. They typically have a life span of 5-6 years and have a fixed return per year, based on the terms of the structure. In their simplest form:

- In year one, the underlying equity index needs to be at or above a certain level for the fixed yearly return to be paid and the structure redeemed.

- If not, the structure rolls on to year two. Each year, the level at which the index needs be to redeem the structure falls, and the fixed annual return accumulates.

- This means that it is possible for a structure to provide a positive return, even when equity markets have fallen.

- Capital invested is at risk, but the teams we appoint to manage these strategies select terms to minimise this risk.

The outlook

Because of the way in which they are constructed, structured product terms (the annual fixed rate and the levels at which they redeem) tend to improve when interest rates are higher and volatility is elevated – a familiar environment.

Within the Fortem Progressive Growth fund, they target 6-7% annual return from their strategy. As it stands, they are behind this trend, given that rates have been low and volatility sporadic over the last 10 years. Despite this, the current environment is providing an exciting opportunity in the space.

As structured product terms are contractual, Fortem can calculate the current return profile of the fund based on various outcomes for markets, and the outlook is positive. If markets were to significantly rise from here, the short-term upside potential of the fund is elevated. Should markets fall from here, this upside would be spread over a longer period, but a material uplift in annualised performance is still due.

Whilst the ‘noise’ of markets is reflected in the pricing of structures as their underlying assets move, this is short term in nature and not reflective of the full return profile of the products or the fund. Longer term, these structures are usually held to redemption, and in most cases redeem within a year or two of inception. This means that capital has been preserved, with a fixed return realised. As it stands, these fixed rates of return are more attractive than they have been in some time.