The threat of cyber attacks to businesses is growing. According to a leading cybersecurity vendor, in the first nine months of 2022, businesses suffered approximately 50% more cyber attacks per week when compared to the first nine months of 2021. In addition, a survey by Allianz Insurance showed that cybersecurity is the biggest concern for 44% of company respondents. Meanwhile, the World Economic Forum ranked cybersecurity failure as the fourth highest critical world threat.

Cost of a data breach

As well as occurring more frequently, cyber attacks are becoming more costly to businesses. In their 2022 Cost of a Data Breach report, IBM stated that the average cost of a breach was $4.35 million, an increase of 2.6% year on year. The healthcare sector bore the highest costs for the 12th year in a row, with the industry averaging $10.1 million in 2022.

In addition:

- 83% of organisations have had more than one breach

- 45% of breaches occurred in the ‘cloud’

- $9.4 million is the average cost of a data breach in the US, more than double the global average and the highest of any country

- Companies using extended detection and response technologies (XDR) saved 29 days in response time

Source: IBM, Cost of a Data Breach Report 2022

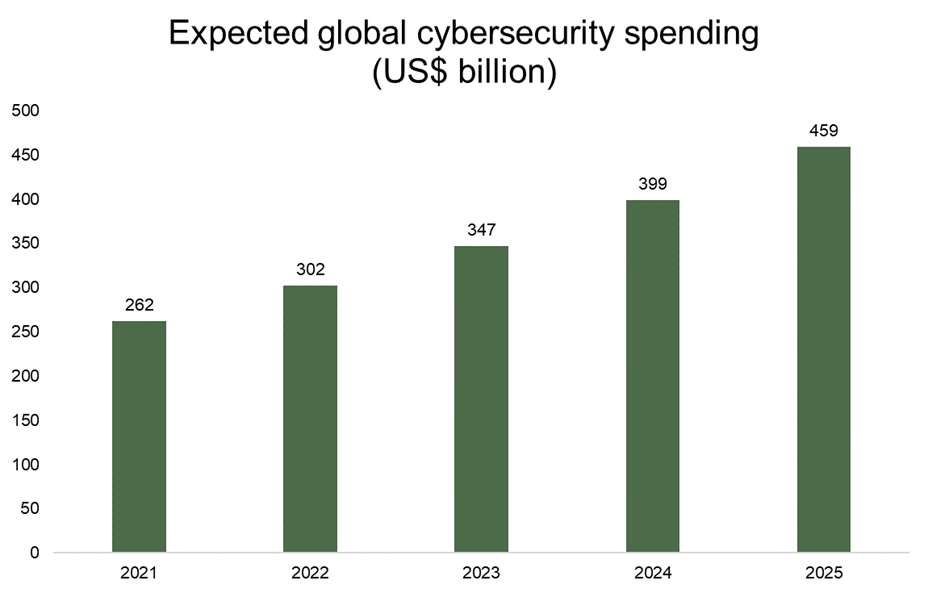

The capital committed by firms to combat cyber threats is growing, and companies offering cybersecurity solutions are the benefactors of this expansion. We believe that there is an attractive long-term opportunity for investors to take part in this growth. Cybersecurity Ventures, who publish Cybercrime Magazine, expected worldwide spending to reach c.$460 billion by 2025. This growth is being fuelled by remote and hybrid working, a transition to ‘zero-trust’ networks, and the move to cloud-based models.

Source: cybersecurityventures.com

Bowmore portfolios

We introduced a direct allocation to cybersecurity in March 2022 at a time when markets had fallen and provided an entry point. Although it proved to be a difficult year for cybersecurity stocks, as it was for the broader technology sector, with rising interest rates providing a strong headwind, we retain our long-term view that cybersecurity revenue streams will continue to grow. Our current holding, the First Trust Nasdaq Cybersecurity ETF, has gained 8.6% year to date, as positive sentiment has been supported by softer rate expectations. We hold this fund across our core and ESG portfolios as a cost-effective way to allocate to this ever-growing theme.