Key takeaways

- Chinese headline inflation comes in negative for July at -0.3%

- Core inflation remains positive, and economic growth in mid-single digits

- Prolonged deflation could support developed economies

Despite investors hoping for a consumer-led revival in 2023, the Chinese economy slipped into deflationary territory in July, with prices falling due to weak demand. Headline inflation came in at -0.3% for last month, year-on-year (YoY). The cost of food, transportation and household goods all declined over the period; pork experienced the most significant fall, with prices down by 26%.

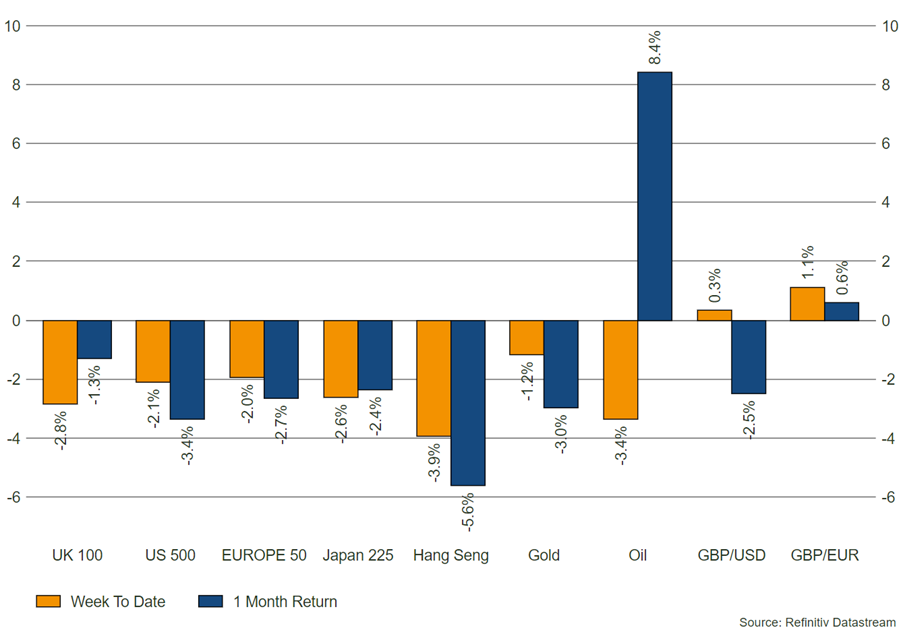

Though markets have sold off, one negative inflation reading does not make a full-blown deflationary trend. Whilst it is true that there are some ongoing stresses in China, such as the health of the property sector, highlighted by the Evergrande crisis in 2021 (yesterday Evergrande filed for bankruptcy in the US), the broad picture is still relatively healthy.

With growth coming in at 6.3% YoY for Q2 2023, the Chinese economy is far from being on its knees. Economists become more concerned about deflation when it is persistent, pervasive, and when companies are desperate to sell to consumers, driving prices ever lower. Core inflation in China (which excludes volatile goods such as food and energy) remains positive, and jumped in July to 0.8%, from 0.4% in June.

Source: Refinitiv

Will this impact other countries?

As we know, in contrast to China, most developed countries have experienced a boom in inflation over the last couple of years; a surge triggered by global supply chain issues following Covid, the Ukraine conflict and huge fiscal expansion, particularly in the US. The battle here has been to bring inflation down, rather than support rising prices, and most of responsibility for this task has fallen to central banks.

The good news for developed central banks is that if the near-term deflation we have seen in China persists, a weaker Chinese economy and currency would alleviate inflationary pressures for countries importing goods from China. Indeed, it has been reported that Chinese state bankers have been selling the US dollar, to help support the yuan, which has lost ground as China continues with loose monetary policy to support growth.

China has contributed around a third of global growth over the past decade, so a prolonged slow down will have a meaningful effect on global trade. However, as many other economies are squeezed by tighter policy and pressured consumers, some respite in the inflation battle would be welcome.

Bowmore portfolios

Whilst we do hold direct exposure to China within our core mandates, we have reduced this over time to dampen volatility and allocate towards strategies that can leverage both the Chinese equity markets, and other emerging themes and economies. We also believe that the economic backdrop in China has the potential to strengthen, with consumers rich with savings and central policy accommodative of growth.