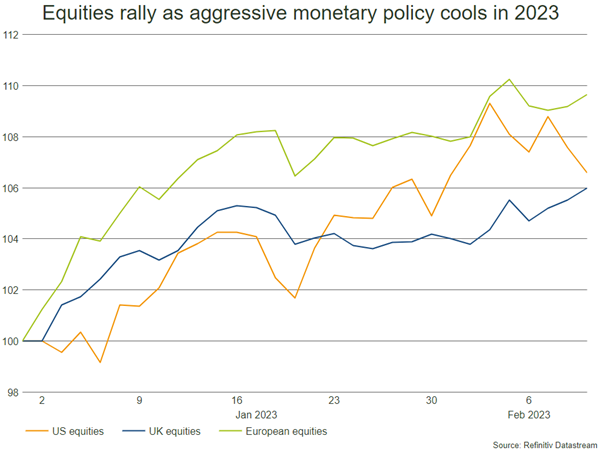

European and US bond prices have rallied since the start of the year thanks to lower inflation expectations and hopes of a soft landing regarding policy rates. Equity markets, in particular growth stocks and small/mid-sized companies, have performed strongly over the last six weeks. With interest rates and inflation remaining in the spotlight, we saw three major central banks hike rates once again last week.

Source: Refinitiv

United States

On Wednesday 1st of February, the Federal Reserve (Fed) raised interest rates by 0.25%, bringing the headline rate to 4.75%, which was widely expected by the market. This rise was half the size of the one in December, which was already a quarter of a percent below that of previous increases. It seems like the Fed is approaching the end of the tunnel regarding monetary tightening, which has supported the recent stock market rally.

From another point of view the situation is not so clear. With inflation falling rapidly, now at 6.5% in the US, and the Fed rate at 4.5%, real interest rates are around -2.0%. This would imply the Federal Reserve is being stimulative; however, as inflation falls real rates will continue to rise.

United Kingdom

On the 2nd February the Bank of England (BOE) announced its tenth rate rise since December 2021. The Monetary Policy Committee (MPC) voted 7-2 to raise rates to 4.0%. The balance of opinion on where rates need to go in the UK is shifting. Two members of the committee voted for no raise at all, and none voted for more than a 0.5% raise, with the sense of urgency to tighten policy waning.

The committee noted that they were expecting inflation to fall quickly in the coming year, forecasting a drop to 3.0% by the end of year. This is still 1.0% higher than the BoE’s annual target but is some way lower than the 10.5% inflation report for December. Core inflation (which excludes the volatility of food and energy prices) hasn’t really moved at all since the July reading of 6.2%, and the UK’s labour shortage is currently not helping reduce inflationary pressures.

The central bank still expects an official recession to hit the UK and will want to soften its monetary policy as soon as possible to boost growth in the coming year. The next vote from the MPC regarding rates might be less conclusive. (Preliminary GDP figures released today show that quarterly UK growth was flat in Q4 2022, narrowly avoiding a technical recession of two consecutive quarters of negative growth.)

Eurozone

Like the UK, on the 2nd of the month the European Central Bank (ECB) raised their interest rate by 0.5% to 2.5% and has already signalled it would enact another 0.5% increase in March. With inflation remaining above target, though falling, ECB president Christine Lagarde said her “job was not done”. Despite this investors focused on the fact that the central bank did not commit to more rate rises after March. European stocks jumped and bond yields fell following her speech.

Bowmore portfolios

As we have alluded to in previous notes, last year’s bear market in stocks and bonds has created an attractive entry point for investors within both asset classes. January 2023 has shown us with inflation on the decline and an improved investor outlook, both assets can deliver positive returns. Whilst we believe the market has priced in much of the bad news, major economies are yet to show how resilient they can be to a tighter monetary environment.

With the path to less aggressive policy set, at least for now, and expectations of a weaker US dollar, global markets have had some room to breathe. Our diversified global portfolio has driven returns year to date, with the likes of Chinese and European equity markets gaining ground. Whilst we remain cognisant of recessionary pressures, markets are displaying more positive sentiment and we have seen this reflected in portfolio values.

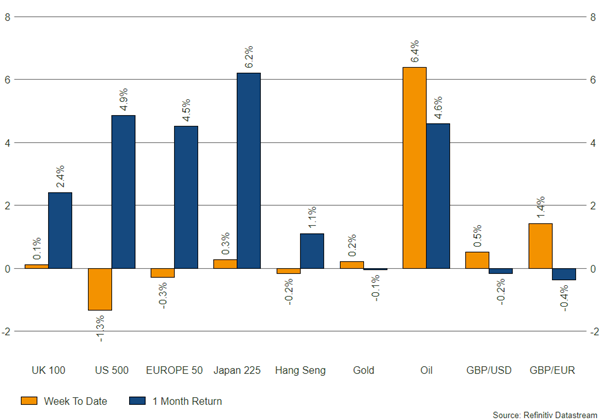

Source: Refinitiv – Market returns as at 09/02/2023