With the first quarter of 2023 drawing to a close last Friday, and a long weekend looming, we are briefly looking back at what has been a varied three months for markets.

Despite the collapse of Silicon Valley Bank in the US last month, and subsequent fallout for wider asset prices, equities gained ground during the first quarter of the year. This positivity was largely propped up by strong January returns, as investors entered the year with the hope that central banks would soften the outlook for interest rates.

Headline inflation continued to ease over the period, mainly due to lower energy prices. Core inflation (which doesn’t include energy) remains stable and has allowed central banks to pursue tighter monetary policy for now. However, concern for banking assets is tempering expectations, and bond markets have reacted positively to this backdrop.

Source: Refinitiv

Looking forward

As inflation and economic indicators come through, the coming months will provide clarity on the flexibility policy makers have. Though expectations of a global recession have all but subsided this year, central banks will have food for thought if we see economic readings deteriorate or further strains emerge within the banking sector. However, stubborn inflation and stronger than expected economic growth would provide head room for banks to turn the screw. We therefore expect volatility to remain elevated in the short term.

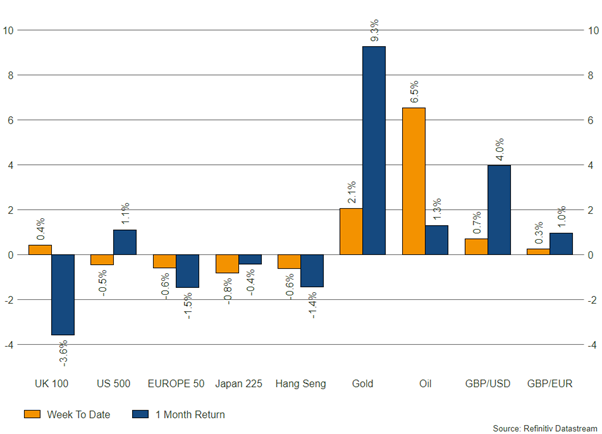

Source: Refinitiv, market returns as at 05/04/2023