Key takeaways

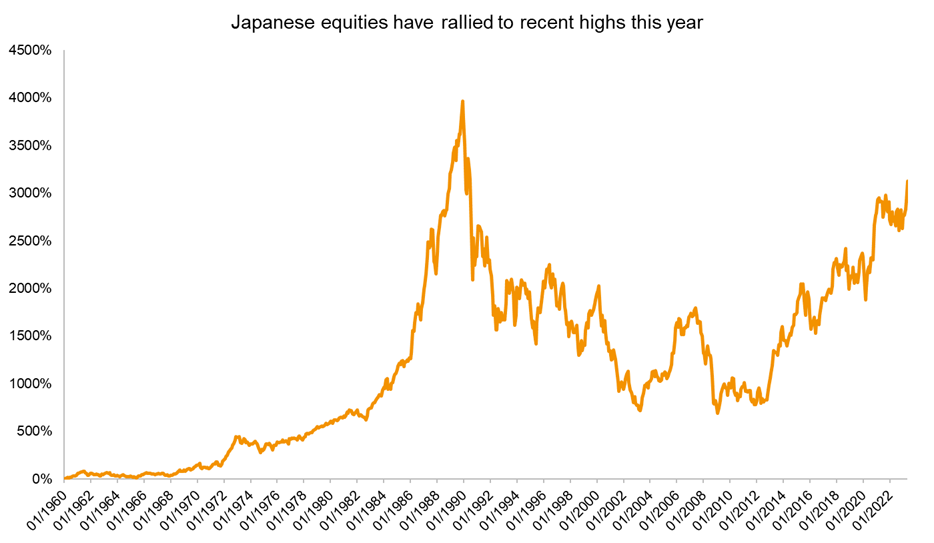

- Japan’s equity market up 24% this year, at levels not seen since the 80’s

- Improved governance and a weak yen help boost asset prices

- Japanese economic growth expected to be 2% in 2023

- Net foreign investment at +$27bn this year

Japan’s rally

After the boom years of the 1980’s, the Japanese stock market has endured a long period of relative under-performance, until now. Last time Japanese equity indices were as high as they are today, was around December 1989, back when the USSR was collapsing. The Financial Times states that so far this year, foreign investors have ploughed $27bn more into Japanese stocks than they have sold, helping to drive prices higher.

For a long period after asset prices crashed in the 90’s, Japanese equities stagnated, and the economy struggled to recover. Corporate management teams lacking motivation to maximize shareholder value left the market under owned and undervalued; however, the landscape has significantly changed in recent years and the country now offers a more compelling opportunity for investors.

Source: Morningstar

New trend

Japanese equities have risen approximately 24% year to date. A cheap yen has helped boost the earnings of firms that generate revenue abroad, and optimism around better corporate governance has improved sentiment (shareholder activism is reaching new highs this year to help spur this on). It helps, of course, that big names in the investment world have made comments about opportunities in the region, with Warren Buffet wading in to add to his portfolio in Japan. In addition, tourism is on the rise, and Japan is seeing visitor levels back to those not seen since before Covid.

Most commentators argue that it is the return of core inflation in Japan that is the main driver of a new positive cycle for Japanese financial markets. Prices excluding food and commodities rose by 3.4% year on year in April, which should help lift wages and, in turn, consumer spending. Improved profitability has helped buoy the stock market, and experts believe the Japanese economy will expand around 2% in 2023.

Bowmore portfolios

We have held exposure to Japan for some time, with the view that improving governance and supportive policy would help drive positivity in the long term. The Bank of Japan looks set to hold steady with its accommodative stance for now, helping support the economy, though we are mindful that inflation is a consideration. We hold a broad exposure to Japanese equities, and we increased this in September 2022 by introducing a fund specialising in Japanese value stocks. If we should see the Japanese central bank moving toward tighter monetary policy in the coming months due to higher inflation, we feel this will be less impactful for companies with lower valuations. For now, investors are enjoying this new brand of optimism for Japan.

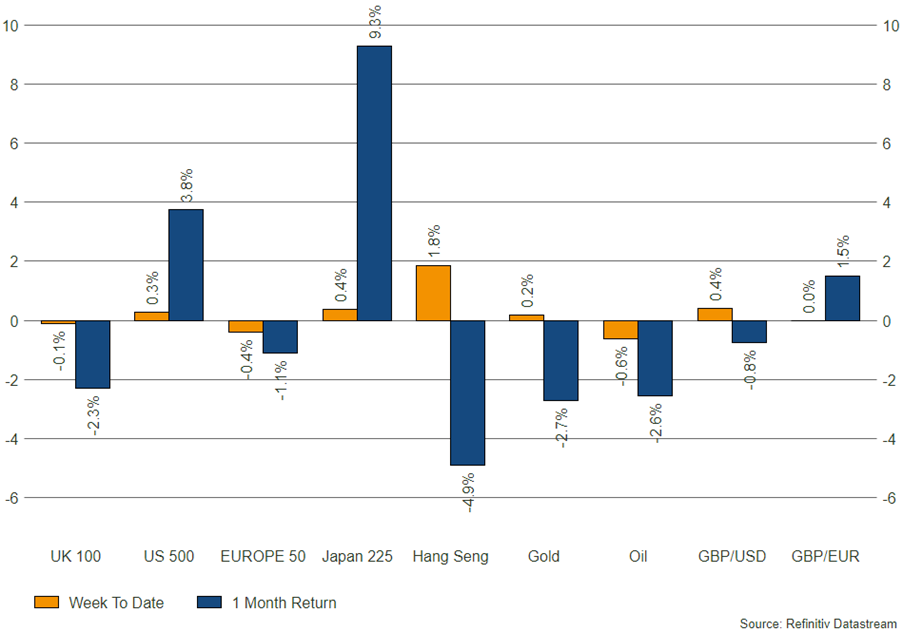

Source: Refinitiv – market returns as at 09/06/2023