Key takeaways

- US government shutdown looms on Sunday if no agreement on funding is reached by Congress.

- Credit ratings specialist Moody’s says this would harm the US AAA rating.

- Senate working on bill to provide short term funding to avoid shutdown.

A US government shutdown?

On Sunday, the deadline for the US government to reach a funding arrangement to avoid a government shutdown will have passed. A shutdown happens when there is a gap in federal funding and the government furloughs federal workers without pay. As it stands, Congress remains at loggerheads over funding, which has caused some volatility to spill into US markets.

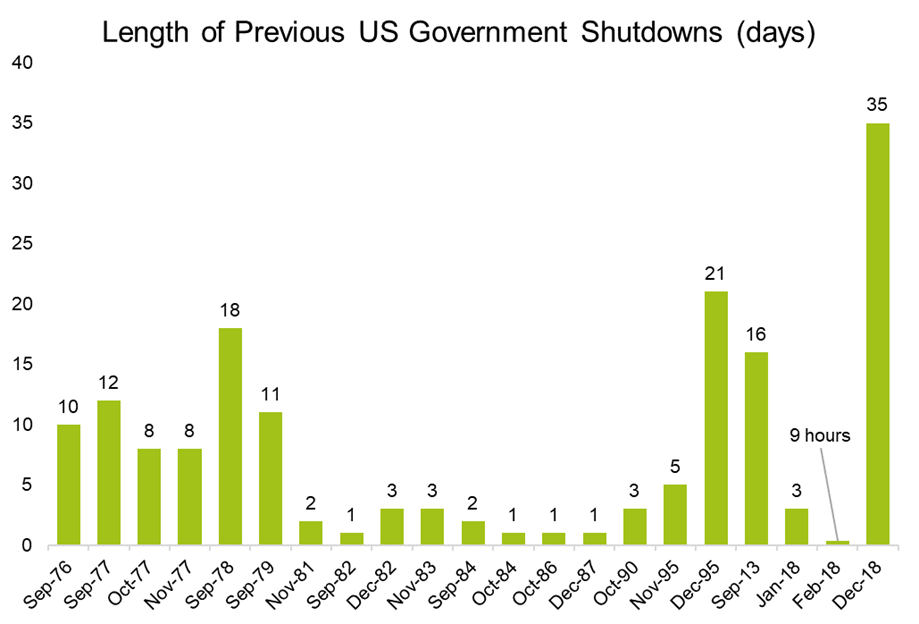

The last shutdown of the US government was under Donald Trump’s presidency, while he was holding out for $7.5 billion to build a wall along the Mexican border in late 2018 (which he never received). This was the longest shut down in US history, spanning a period of 35 days.

Source: pbs.org

The difference this time around is that December 2018 was only a partial shutdown, where key services remained in place. If a deal is not reached this weekend, a full shutdown of the US government will occur, including the publication of key economic indicators, such as inflation and employment data, potentially leaving the Federal Reserve uninformed going into their November meeting.

The good news is that the Senate, the upper chamber of US congress, has been working on a bipartisan bill to put a short-term funding plan in place and avoid shutdown. The difficulty appears to be passing this plan through the House, the lower chamber. It may be that ongoing wrangling over the bill spills into Monday, but there is hope of reaching an agreement.

Moody’s, the credit ratings specialist, has commented that a shutdown would harm the US government’s credit rating, with concerns over the effects of political polarisation and widening fiscal deficits. Moody’s is currently the only ratings provider to assign a AAA rating to the US after Fitch downgraded the US in August.

Bowmore portfolios

We took some profits from our US equity index allocation in July, and this week halved our global equity tracker exposure. Though the turning point for interest rates will provide a platform for risk assets in the medium term, we are happy to hold higher levels of cash in the short term as risk events play out.