Key Takeaways

- US small cap stocks outperformed large caps by 1.7% annually from 1926 to 2022

- The current valuation differential between smaller and larger companies is the widest it’s been since 2003

- Global slowdown ending and imminent rate cuts create an opportunity for small caps to outperform once again

The small cap premium has been a thoroughly researched, and sometimes debated, topic in investment philosophy for decades. The data, however, suggests that over the long-term small caps outperform large caps. In the US, small caps have beaten large caps annually by 1.7% between 1926 and 2022. Fundamentally, this is due to their share price growth potential. A mere 10% increase in Apple’s share price means its market cap has to increase by c.$267bn. Smaller companies can be more innovative and have the opportunity to exponentially increase revenue and earnings.

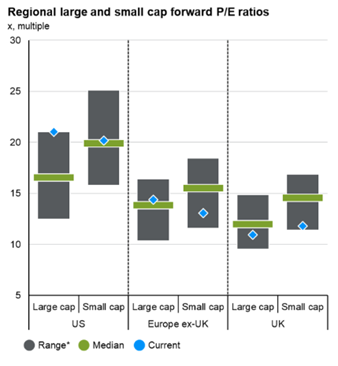

Markets are efficient though, and smaller companies’ growth potential has almost always translated into them trading at a premium to their large cap counterparts. However, after two decades, the opposite is now true in the US and Europe as shown in the chart below:

Source: JPM Guide to the Markets (Small Caps), 31 March 2024

In the UK, whilst small caps are trading on a slight premium to large caps, valuations are right towards the bottom of their historic range (since 2008). Meanwhile, mid-caps in the UK are cheaper with the FTSE 250 trading on a forward PE of 11.3 vs the FTSE 100’s 11.6.

Why are small caps so cheap?

- There is an increase in profitless small cap stocks. 45% of the Russell 2000 companies are not generating a profit vs its long-term average of 27%.

- An increased proportion of promising smaller companies are being taken private and unlisted smaller companies are staying private for longer.

- Smaller companies in the US have a greater proportion of their debt at a floating rate (i.e. it varies with interest rates) versus larger companies that have more of their debt at a fixed rate. Specifically, 38% of Russell 2000 debt is floating rate compared to just 7% for the S&P 500.

- Smaller companies also tend to be more leveraged than larger companies as they seek to grow with net debt/EBITDA at 3.2x for the Russell 2000 and 1.6x for the S&P 500.

Importantly, the last two points make them much more sensitive to interest rate rises.

It is no surprise then that smaller companies are trading on a discount to larger companies in a high interest rate environment amidst a global slowdown. However, we believe the divergence in valuations is now so great that it presents a very attractive opportunity, particularly considering the improving global economic outlook. The Fed looks to be on track to achieve their soft landing, the UK economy is potentially out of a recession following early estimates of GDP growth in February, and developed market central banks are generally talking about interest rate cuts.

The heavily discounted valuations and low earnings expectations provide both downside protection and significant upside potential in the long-term. Trainline, for example, beat EPS expectations by 20% in May 2023 and its share price subsequently surged 15% in the week and is up more than 40% since then. Our Q1 market overview, published earlier this week, discussed the increase in takeover activity within the UK which provides further evidence in the value of the UK smaller company sector. Mattioli Woods was snapped up last month at a 35% premium to what the shares were trading at, at the time.

Bowmore portfolios

These views are reflected in our portfolios, where we have recently increased our small cap exposure to c.18% within the equity allocation of our Risk 5 portfolio, an overweight position when compared to the global market. Within the small cap exposure, we have opted for active management where managers can capitalise on a less researched, and therefore less efficient, market to generate positive alpha.