Key Takeaways

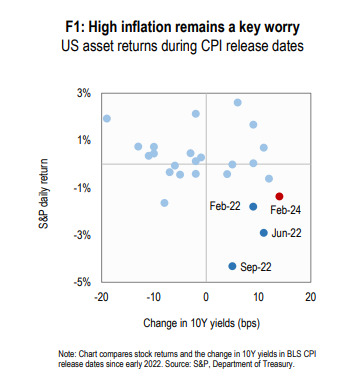

- US inflation was higher in February than in January

- Higher Inflation will force central banks to keep rates higher for longer

- Chart F1 shows that as bonds yields rise the S&P equity market falls

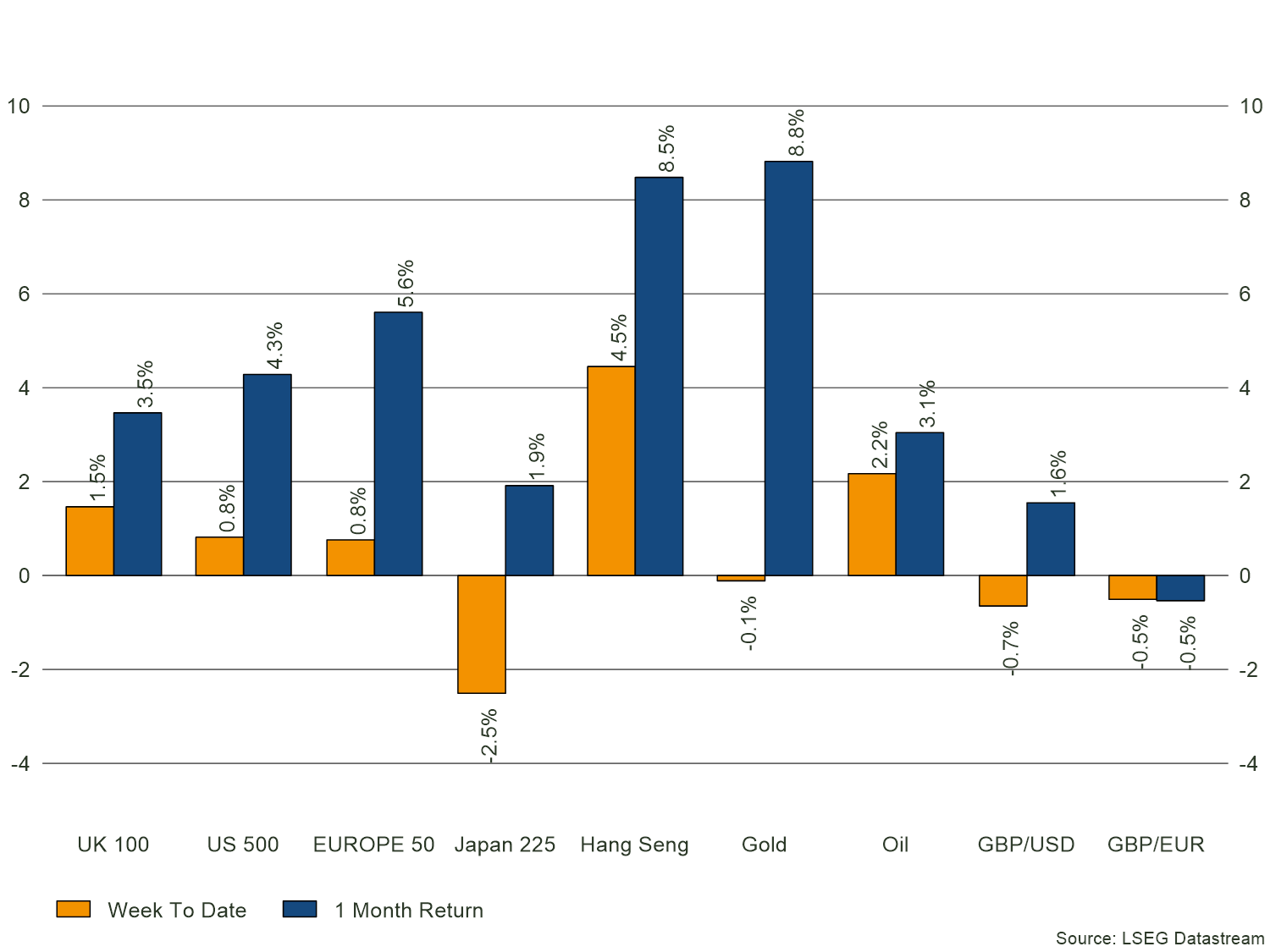

Inflation was long forgotten in the developed world but over the last two years it has emerged as a major concern and driver for stock market returns worldwide. While moderate inflation is often considered a sign of a healthy economy, higher inflation rates can cast a shadow of uncertainty over financial markets, leading to volatility and eroding investor confidence. As you will see from the chart below, US stock market returns have been driven by the inflation data over the last couple of years, with concerns of higher inflation being met with negative stock markets.

US inflation was 3.2% for February with higher petrol, housing and service sectors being noted. This was marginally higher than January.

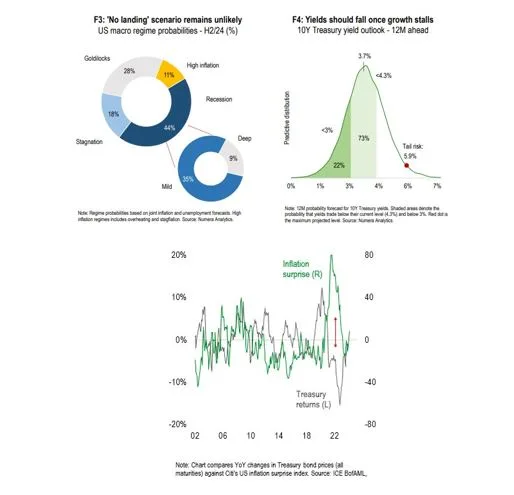

Who would have thought after years of Fixed Interest investments offering little or no returns that we could find ourselves being hungry for offsetting equity risk once more with government and corporate debt. Investing in bonds once again offers the chance of investing in an asset class with a yield above inflation and the chance of capital appreciation as interest rates fall. We are being paid to wait and so we have been increasing our allocations to this sector in areas that are uncorrelated to equity markets. If growth remains positive, but sluggish, then it is likely that falls to inflation are slower than people would like.

You can see data produced by Numara Analytics that suggests an 11% chance of higher inflation, with a 44% chance of a US recession, suggesting that no clear picture emerges. With the government spending 44% of GDP in 2020 and continuing above average spending, a recession has been held off, but will this continue? As and when we see declining growth we should see yields fall and bond prices rise.

Why is high inflation so damaging to investors

- It reduces what you can afford to buy

- It forces central banks to increase rates, which means debt costs rise and consumer spending falls. US GDP is 75% based around consumer spending.

- It causes uncertainty, as the inflation surprise chart shows, people and markets like certainty. Sharp unexpected price changes force people to increase prices to protect themselves against unforeseen rises. Prices then rarely fall back!

- Inflation has an inverse relation with Fixed Income assets. High inflation destroys coupon values and therefore forces bond prices to fall. The opposite happens with falling inflation and so this is why we think bonds are attractive at the moment.

Bowmore Portfolios

Inflation shocks and higher rates remain a significant probability. We have therefore reduced our alternative exposure to increase our fixed interest exposure to benefit from higher yields while we wait for interest rates to fall. We think they will fall but only marginally back to longer term averages.

Whilst in the run up to a US election we are holding our equity weightings at the top end of ranges, we want to ensure that we are holding sufficient bond exposure (where relevant to your risk profile) as an insurance policy against growth slowing faster than we expect and central banks being slow to react to such changes.