Key takeaways

- Netflix shares surge more than 16% on subscriber growth.

- Nine million subscribers added in Q3 2023.

- Microsoft acquires Activision Blizzard for $69 billion

Netflix

During US trading yesterday, Netflix shares jumped more than 16% on the back of strong subscriber rates. The streaming and content provider saw its share price register its largest gain in nearly three years as it announced that 247 million people subscribed to its service in the third quarter of this year, adding nine million over the previous quarter.

This growth flies in the face of challenges faced by the sector, including a Hollywood strike due to labour disputes. Netflix’s language capabilities and licensing agreements has helped it reach a global audience and utilise older content at a time when making new content has been difficult.

Netflix had this year already boosted subscriber numbers by cracking down on shared accounts, offering a range of access from lower-cost streaming with adverts, to ad-free premium viewing. This tiered restructure followed a fall in the number of Netflix subscribers in 2022.

Microsoft and Activision Blizzard

In other stock-specific news, it was announced last week that after nearly two years of regulatory oversight and investigation, Microsoft has acquired Activision Blizzard, the video game producer, for more than $69 billion – the largest acquisition within the gaming industry.

The deal had been plagued by concerns over competition from regulators, something that was encouraged by competitor Sony. As the producers of the Xbox games console, Microsoft have been in direct competition with Sony’s PlayStation consoles for years, and there were concerns that Microsoft may choose to freeze Sony out of providing certain games franchises, such as Call of Duty, after the acquisition. However, the market share that Sony holds with the PlayStation is so large this would be detrimental to Microsoft and revenue made through those titles.

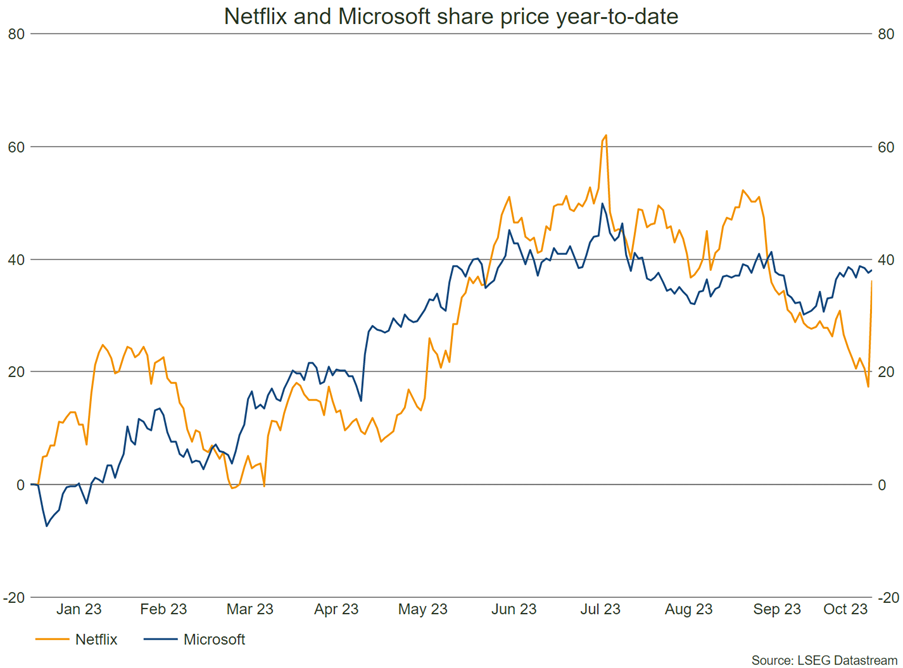

Support for large tech firms has returned this year, with Netflix and Microsoft up c.36% and c.38% year-to-date respectively. The latter has clawed back most of the ground lost during the growth sell-off in 2022. Netflix remains down c.33% since the start of last year but has also regained value having been down c.72% at its nadir during that period.

Bowmore portfolios

Although we do not hold exposure to direct stocks in portfolios, we do allocate to technology and cyber security thematic funds, which have benefitted from positive momentum in these sectors this year. Our cyber security allocation is up 17.8% year-to-date, with tech up 40.4% in sterling terms.