Key takeaways

• Bank of England keeps interest rates at 5.25%.

• UK headline inflation at lowest level since February 2022.

• Weaker economic indicators driving rationale for pause.

Bank of England pauses

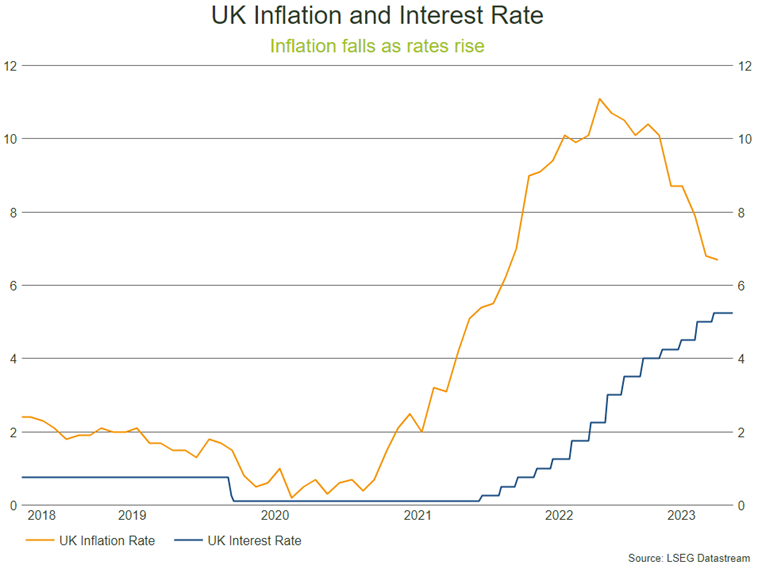

Yesterday, the Bank of England (BoE) decided to keep its policy rate steady for the first time after a stint of 14 consecutive hikes, leaving the UK’s interest rate at 5.25%. This is the first pause implemented by the Monetary Policy Committee (MPC) since December 2021, at a vote of 5-4, and followed the US Federal Reserve’s decision to also hold rates level on Wednesday.

In a move that will provide some relief to consumers and homeowners, the BoE has slowed its aggressive policy to combat inflation, as economic indicators have started to show the impact of higher rates. Headline inflation fell in the UK to 6.7% in August, below consensus expectations of 7.0%, and to its lowest level since February 2022.

Source: Refinitiv

In addition to the inflation surprise on the downside, the MPC also stated there are “increasing signs of some impact of tighter monetary policy on the labour market and on [economic] momentum”. A weaker housing market, modestly higher unemployment (4.3% for July), and lower growth expectations have been cited as rationale for the pause.

Despite this more dovish action from the MPC, BoE Governor Andrew Bailey reiterated the need for vigilance should rates require hiking once more, and the intention to keep them elevated for long enough to “get the job done”.

Bowmore portfolios

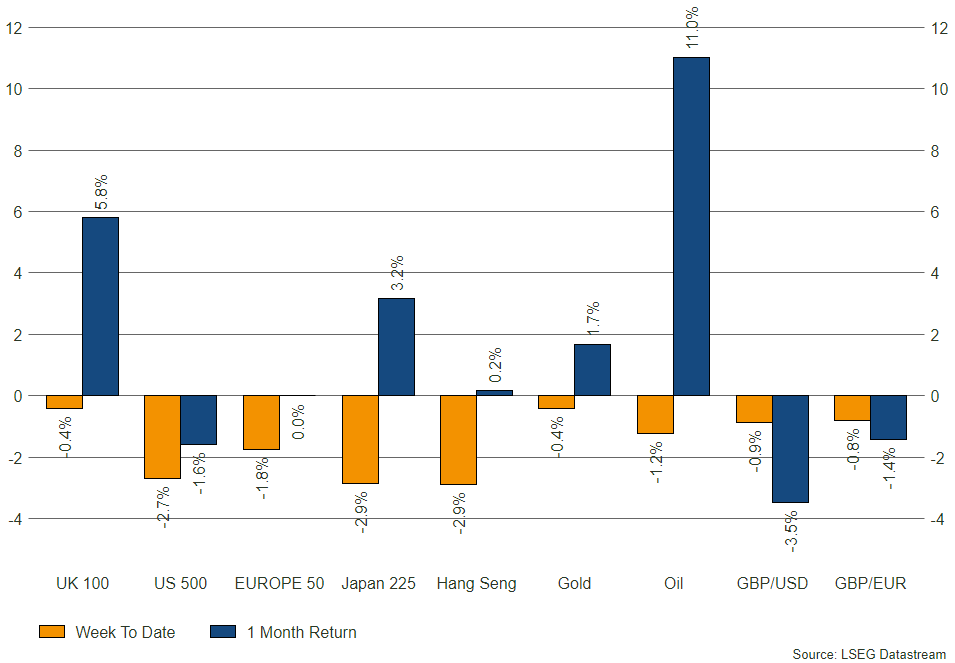

With UK and US rates on pause and European rates looking to have peaked, risk markets will be buoyed by less aggressive monetary policy. Global equity markets are still down 10.7% since the beginning of 2022 in US dollar terms, and as the point for rate cuts draws closer, there is room for positive momentum to build. When interest rates do start to fall, this will also be supportive for bond markets. In portfolios we have, over the last 12 months, allocated into a more attractive bond landscape, adding exposure to corporate and UK government debt, which provide an income stream, the opportunity for capital growth, and in the case of UK gilts, downside protection should economic conditions deteriorate further.