Key Takeaways

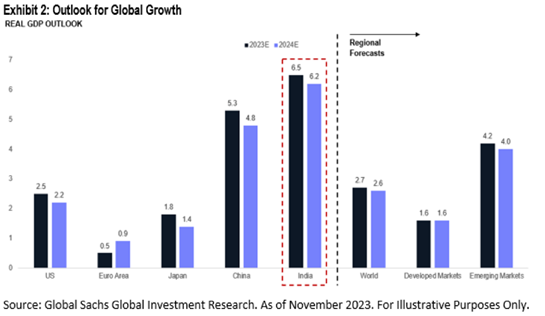

- India is already the world’s sixth-largest economy and is poised to drive a fifth of global growth through the end of this decade

- India has grown seven-fold in the last 20 years (7.2% last year) and its GDP should exceed $5bn (ahead of Japan) by 2027.

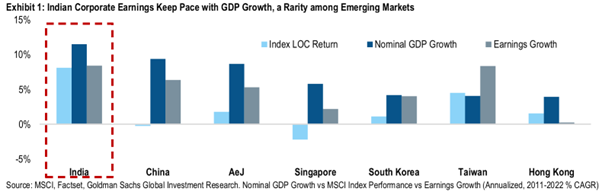

- MSCI India returned 21% outperforming broader Emerging Markets for the third year in a row. Bowmore hold a direct India exposure which has benefitted from this rise.

India is one of the fastest-growing and most populous economies in the world, with a GDP of $2.9 trillion in 2021 and a growth rate last year of 7.2% in 20224. India’s economic potential is driven by several factors, such as its large and young population, its urbanization and digitalization trends, its infrastructure development, its manufacturing and export capabilities, and its free trade agreements with key partners.

Below we have listed some of the major themes that are shaping India’s growth story and creating ongoing opportunities for investors.

Rising incomes and consumption – India’s urban per-capita income is projected to increase from $2,200 in 2021 to $4,700 by 20301, which will boost the spending power and demand of the middle class. India’s consumption patterns are also influenced by its local preferences and culture, such as its taste for Indian food and beverage options, personal care products, and private labels. Moreover, India’s consumers are benefiting from the leapfrog effect of mobile-first, which enables them to access financial products, formal retail, and digital content via smartphones1. We are also seeing a resurgence in the motorbike trade which was brought up to western standard in 2019 (insurance & emissions).

Technology and finance innovation – India is revolutionizing its tech and finance

landscape with its technology, which is a set of digital platforms and applications that provide public goods and services to citizens and businesses. For example, India’s Aadhaar system is a biometric identification system that covers over 1.2 billion people and enables them to access various government and private services, such as subsidies, banking, and e-commerce1. India’s Unified Payments Interface (UPI) is a real-time payment system that allows users to transfer money across different banks and wallets using their mobile phones. India’s technology is also fostering the growth of new business models, such as the sharing economy, service aggregation, and subscription services.

Infrastructure development – India is investing heavily in improving its infrastructure, especially in the areas of railways, renewable energy, and urban development. India’s railway network is the fourth-largest in the world, carrying over 8 billion passengers and 1.2 billion tons of freight annually. India is upgrading its railways with new fast trains, electrification, and modernisation projects1. India is also a global leader in renewable energy, with a target of installing 450 gigawatts of renewable capacity by 2030. India’s urban development initiatives include building smart cities, affordable housing, and metro systems.

Manufacturing and export expansion – India is aiming to become a global manufacturing hub and increase its share of exports in the world market. Apple and many others are starting to diversify from China and moving to India. India has launched the Production-Linked Incentive (PLI) scheme, which offers financial incentives to domestic and foreign manufacturers in 13 key sectors, such as electronics, automobiles, pharmaceuticals, and textiles. India is also pursuing free trade agreements with major partners, such as the European Union, the United Kingdom, and the United States, to enhance its market access and competitiveness. The “Make in India” program is becoming a reality, with the world’s largest contract manufacturer announcing plans to double its Indian workforce to 50,000 and invest US$2.7 billion in Karnataka state. This is the latest large-scale announcement following those related to research and development into artificial intelligence chips (4,000 jobs) and semiconductor investment (5,000 jobs).1

India’s growth drivers are not only creating economic value, but also social and environmental benefits. India’s technology and finance innovation is improving the inclusion and empowerment of its citizens, especially the poor and marginalized. India’s infrastructure development is enhancing the quality of life and mobility of its urban and rural population. India’s manufacturing and export expansion is creating jobs and income opportunities for its workforce. Beyond services, India is a global leader in pharmaceutical manufacturing, producing 60% of global vaccines and accounting for 20% of global pharmaceutical exports.1Household spending should remain resilient given increasing job opportunities for skilled workers and increasing wages for the unskilled. The switch to organized economic activities and a decline in the cash- based economy are driving the latter. We believe there is significant potential for growth in credit penetration in India, which is currently 40% of GDP, compared to an average of 63% in emerging markets.2

Bowmore portfolios

We are pleased to maintain both our direct and indirect exposure to India which is giving us exposure across the capital spectrum. The MSCI India Index price-to-earnings ratio (P/E) is currently trading above its 10-year average, based on 2024 consensus earnings forecasts.2 Looking ahead, earnings growth in 2024 is forecast to rise 17%, and despite market performance (represented by the Nifty 50 Index) being positive, it has lagged cumulative earnings growth of 31%1 Other markets may trade on a lower P/E, but in our view, they do not have the long-term growth potential of India.

Whilst India is benefiting from importing cheap Russian oil, it is also moving forward with its green transition. Electric vehicle manufacturing, solar panel production, and decarbonisation of high carbon-emitting industries represent opportunities. Historically, India’s reliance on imported fossil fuels has negatively impacted the fiscal deficit and input costs. However, growth in cheap renewable energy is increasing the competitiveness in heavy industry and petrochemicals, as well as lowering the cost of transportation. India’s largest conglomerate, which is also its biggest petrochemical producer, has a net-zero target of 2035. This is earlier than India’s current net-zero target of 2070

India’s growth story is not without challenges, such as the COVID-19 pandemic, the geopolitical tensions, and the environmental issues. However, India’s political leadership, resilience and adaptability, along with its diversified and dynamic economy, make it a positive longer term invest theme that we are happy to support.

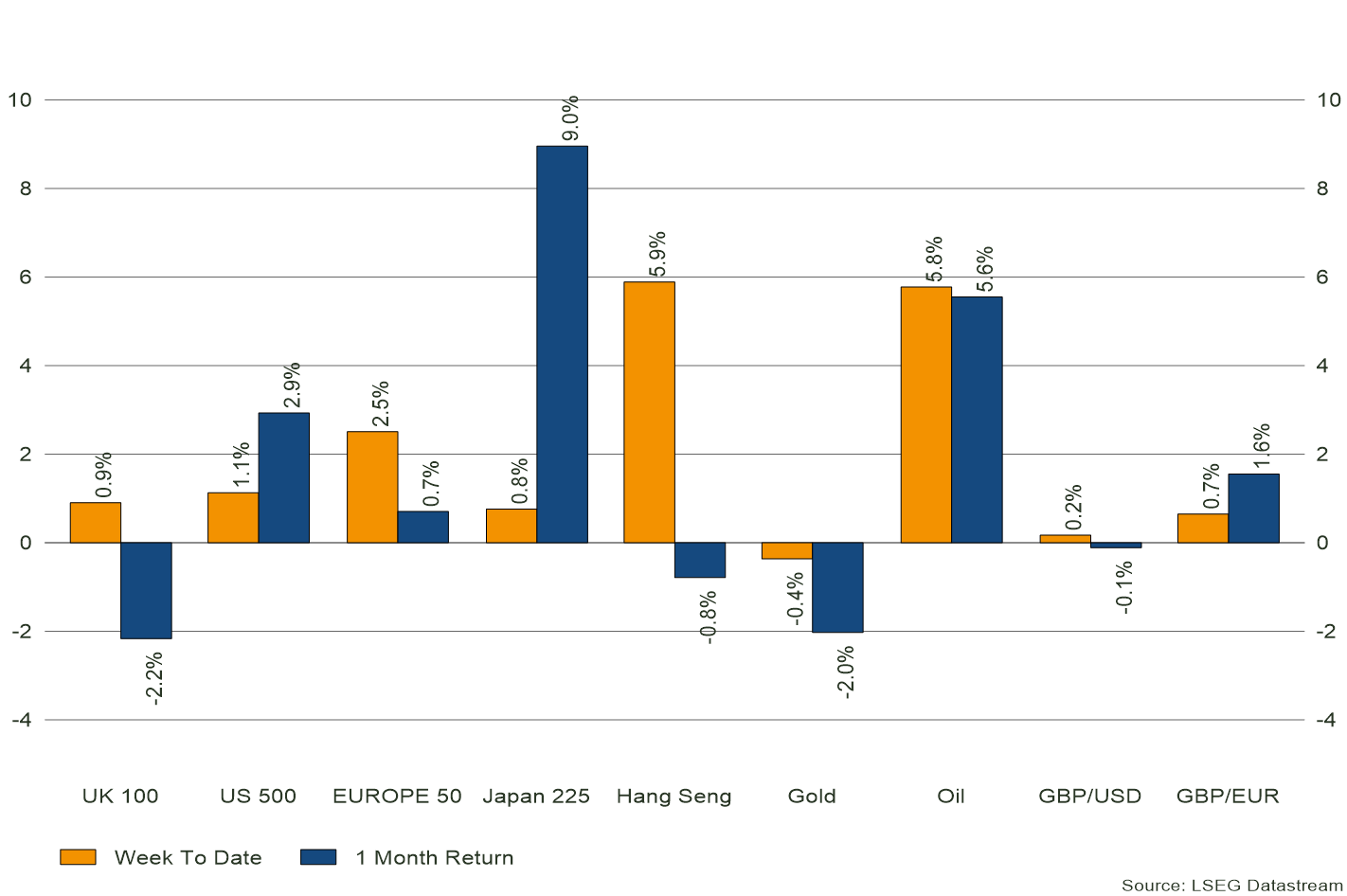

Source: LSEG Datastream – Market Returns as at 26/01/2024

1. Source: Franklin Templeton, FactSet.

2. Source: FactSet. December 6, 2023. There is no assurance that any estimate, forecast or projection will be realized.

3. Source: Ibid

4. Source: Legal & General