Key takeaways

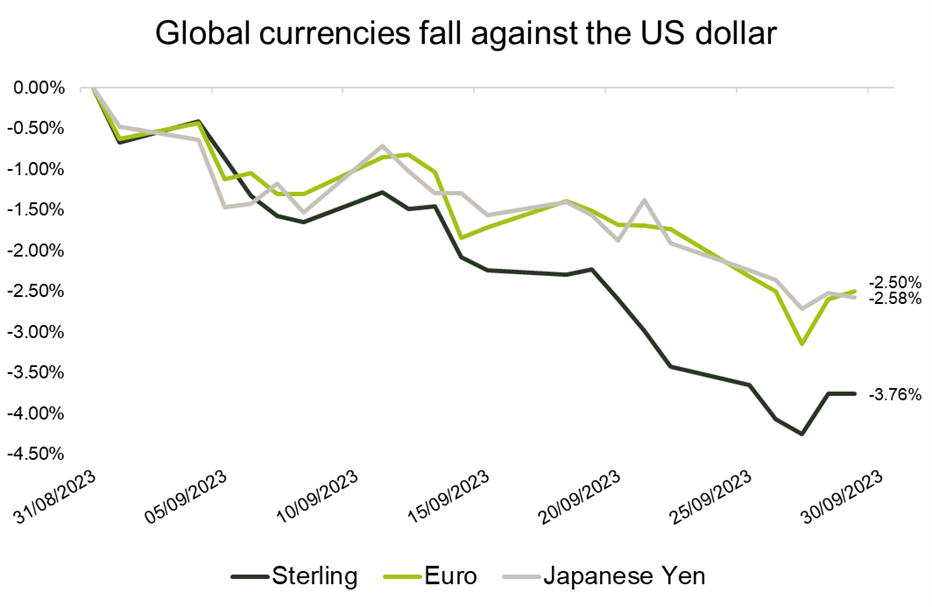

- US dollar index up 2.5% in September.

- Dollar strength supported by higher for longer interest rates.

- 10-year US treasury yield reaches 2007 levels.

US dollar strength

Throughout September the US dollar index, which is measured against a basket of currencies, rose 2.5%, a move which has been supported by a sell-off in US government bonds, with the US 10-year treasury yield moving up to 4.8%, its highest since 2007.

Treasury yields have moved higher as investors are coming to terms with the idea that interest rates are likely to stay elevated for longer, as the US economy continues to look robust, even as monetary policy has tightened. If macro-economic data remains positive, this will be supportive for the dollar.

Source: Refinitiv

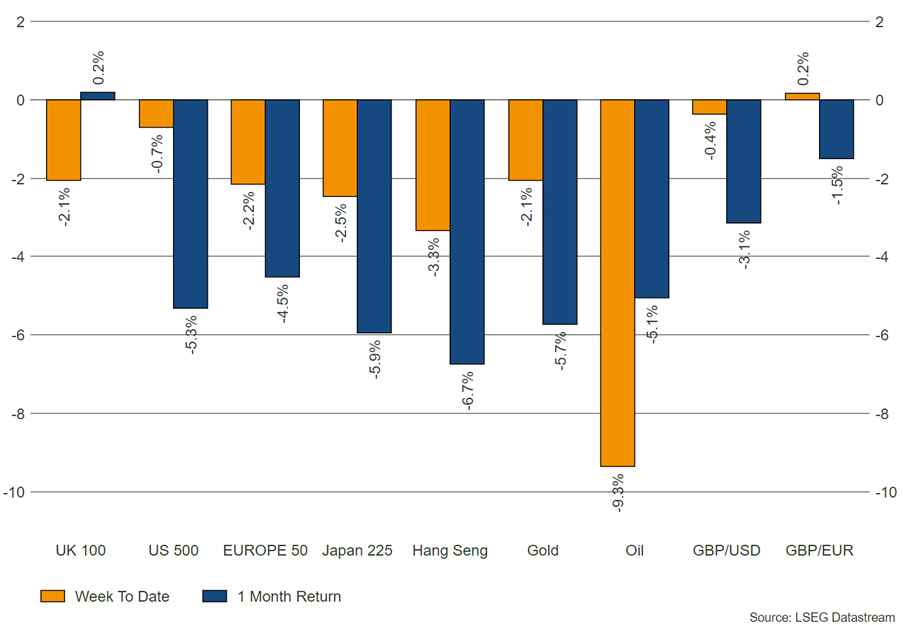

Over the course of last month, sterling fell 3.8% against the US dollar, whilst the euro and the Japanese yen also gave up ground against the greenback, falling 2.6% and 2.5% respectively. Recent slides for the yen have pushed the exchange rate to levels not seen since last year and, prior to this, 1998, prompting some to question whether or not the Bank of Japan will intervene to shore up its currency.

Bowmore portfolios

As we manage a globally diversified portfolio of assets, we have exposure to the US dollar, with much of this coming from our US equity and thematic allocations. When the dollar strengthens against sterling this is beneficial for portfolio performance, as assets are worth more when they are priced back into pounds. With risk markets falling through September, dollar strength offset some of the losses we saw in dollar denominated assets. Whilst this is positive for returns, we do not actively trade currencies to add value, as foreign exchange markets can be fickle and volatile. However, we do hedge out some currency risk. When the Federal Reserve starts to loosen its stance on monetary policy, this will be less supportive for the dollar.