Key takeaways

- The European Commission has announced details of its Green Deal Industrial Plan, which enhances the competitiveness of Europe’s net zero industry and accelerating the transition to carbon neutral.

- The deal covers four different aspects: faster access to funding, enhancing skills, open trade and simplifying the regulatory environment.

Earlier this year, the European Commission set out its Green Deal Industrial Plan (GDIP), following the passing of the Inflation Reduction Act (IRA) in the US last year. Through the GDIP, the European Commission has set out plans to create a more supportive environment for clean tech manufacturing and increase the capacity required to meet Europe’s ambitious green targets. They want to be the first climate-neutral continent by 2050.

The Inflation Reduction Act

Last year, the US announced the implementation of the Inflation Reduction Act, which offers $369 billion of subsidies for electric vehicles and other clean technologies. The subsidy has provoked concerns among US trade allies, including the European Union, South Korea and Japan, who fear that their companies will be incentivised to relocate their operations to North America. As an example, Volkswagen already announced pausing plans to build a new factory in Eastern Europe and instead are planning one in the USA.

Four pillars of the new GDIP

To secure Europe’s place as the home of industrial innovation and clean tech, the green deal will cover four key pillars:

A predictable and simplified regulatory environment

- Quicker deployment of manufacturing capacity

- Affordable and sustainable energy

- A net-zero industry act

Speeding up access to finance

- Access to greater and quicker national, and EU funding

- Creation of multiple funds within specific investment targets

Enhancing skills

- Development of better green and digital skills sets

Resilient trade and supply chains

- Diversified access to critical inputs

- Free trade agreements, creating more partnerships

Expectations for these new deals

These new deals are certainly bringing more government influence on trade policy, which had already picked up due to the pandemic. The ever more urgent need to decarbonize our economies for the good of the environment has required more state intervention and increased spending from governments. This is expected to pour more support into the already powerful sustainable revolution; however, these green subsidies will also increase demand for critical minerals such as Lithium, posing the question of what unintended impact this demand may have on the environment beyond carbon reduction. Meanwhile, the IRA and GDIP are putting pressure on and increasing competition with China, who would be hard pressed not to see these bills as protectionist policy.

Bowmore portfolios

Financial markets in the US have reacted positively to the Inflation Reduction Act (though many have queried the naming of a stimulatory bill) and we believe the GDIP will have the same effect in Europe. We feel the European bill will benefit technology companies and those that are well positioned from an ESG stand-point, with sustainable and green practices being core to the policy. We invest into sustainable energy within both our Core and ESG strategies, as we have felt for some time this will be long-term growth story that can only gain traction. With policymakers adding support to this trend, our conviction is galvanised.

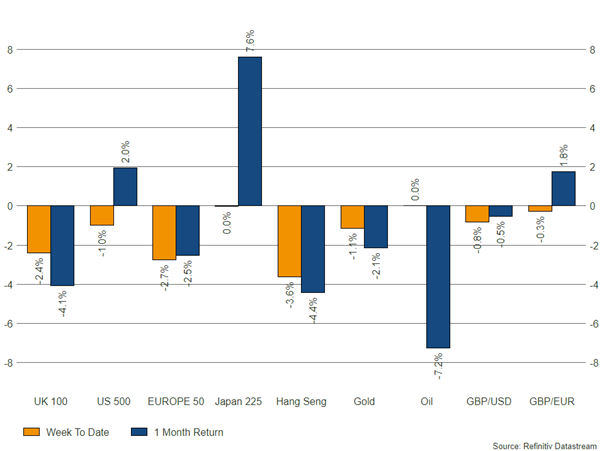

Source: Refinitiv – Market returns as at 26/05/2023