As we wrote last week, the second half of March has played host to high volatility across global markets and the banking sector after US lender, Silicon Valley Bank, went bust. In Europe, the 167-year-old Swiss bank, Credit Suisse, had encountered problems of its own. With the Swiss regulator, FINMA, coming in to help, a deal was brokered for competitor UBS to buy the beleaguered bank for three billion Swiss francs over the weekend.

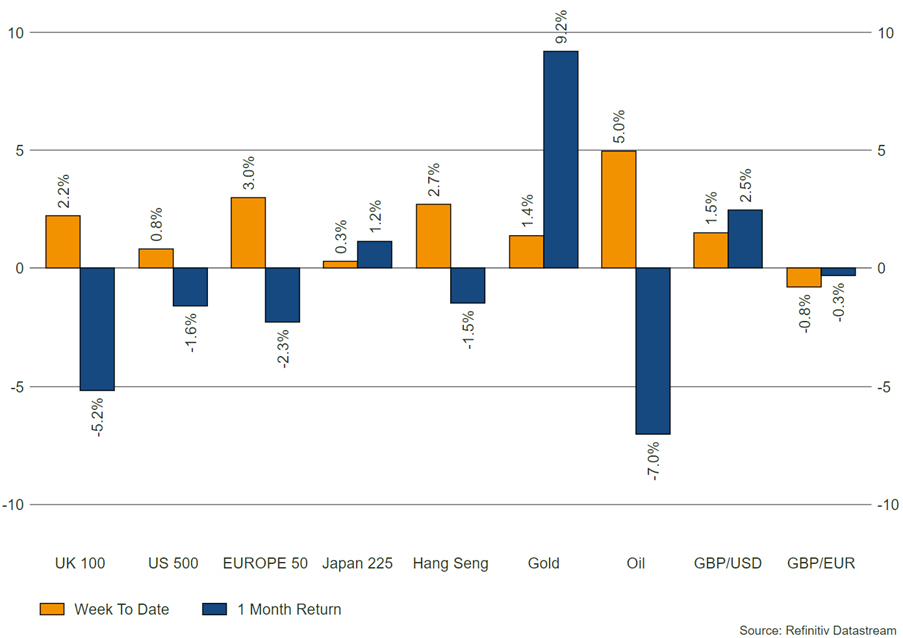

Market reaction

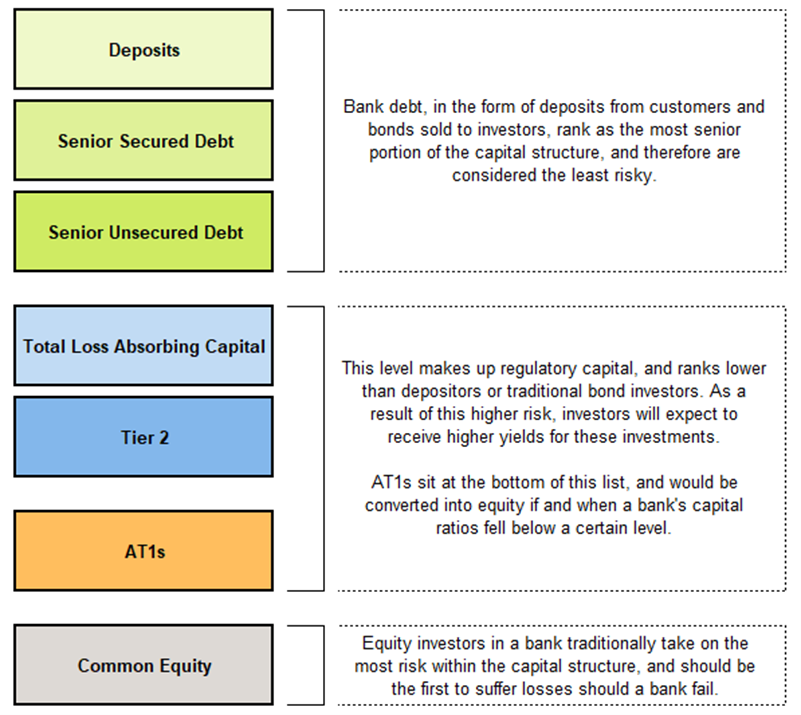

With the failure of a bank as large as Credit Suisse avoided, this was largely good news for markets and global banks rallied. However, much has been made of the nature of the takeover, and the way in which some of Credit Suisse’s bond holders have been treated. To understand this further, we first need to look at AT1s, or Additional Tier 1 bonds.

What are AT1s?

Put simply, AT1s are a type of bond issued by banks to investors. These types of bonds are also called Contingent Convertibles (CoCos for short). Following the Global Financial Crisis, regulators placed tighter requirements on banks to hold higher levels of capital to cover losses made by their lending and investment activities. This is where AT1s come in.

Within the capital structure of a bank, there is a hierarchy placed on assets, which defines the level of security an investor can expect should the bank get into financial trouble. AT1s sit towards the bottom of this list and therefore pose the highest risk. This provides the upside of a higher income paid to investors, but should a bank’s capital ratios (a measure of capital viability set by regulators) fall below a certain point, these AT1s can be converted into equity in the bank; the riskiest asset in the list.

What happened at Credit Suisse?

Over last weekend, the Swiss regulator oversaw the deal for UBS to purchase Credit Suisse. This effectively provided a payment to existing equity holders and prevented the bank going bust. It wasn’t a government bailout, but it was a form of bailout provided by UBS to those investors, backed by government guarantees. As we have seen from the above chart, equity is the most subordinated of securities within the capital structure. As these investors were paid for the sale of the bank, investors higher up the chart should have been safe from being wiped out. This, however, was not the case.

AT1 debt holders saw their assets written down to zero. This forwent any conversion into equity, and assets became worthless overnight. Naturally, Credit Suisse AT1 holders are not happy about this, and neither were markets. The Swiss regulator completely changed the way in which these assets are supposed to behave, and as a result confusion and uncertainty prevailed on Monday. AT1 markets dropped around 10% in US dollar terms, as it seemed there was no longer a rigid framework for investors to rely upon.

However, other parties were quick to step in and provide some stability and assurance. The European Central Bank (ECB) on Monday said that “common equity instruments are the first ones to absorb losses, and only after their full use would Additional Tier One be required to be written down”; a comment that flies in the face of what happened to Credit Suisse investors and setting out the ECB’s stall clearly for all to see. They wanted to make it clear that EU-regulated banks would adhere to the status quo. The Bank of England echoed these sentiments.

As the week progressed many AT1 bonds recovered from their drawdowns, as clarity permeated markets and central banking efforts clearly had a positive impact. This is good news in the long term, as central bankers have worked to shore up the wider banking industry in the wake of SVB’s failure and other weaker banks being exposed.

Bowmore portfolios

We do not hold a direct allocation to AT1 bonds within any of our portfolios. Though higher yields can be obtained from these types of assets, the nature of these instruments requires close analysis of bank-specific health and metrics, and we prefer to allow our bond fund managers to be selective in their allocations in this space. Within the fixed interest funds to which we do directly allocate, exposure to AT1s is not a driving theme in the selected strategies.

Source: Refinitiv – Market returns as at 23/03/2023