With the new year now in full swing we have started to see quarterly, and annual results being published for a number of investment trusts and private equity firms, and the numbers are not flattering, especially for those companies specialising in growth and more bullish/speculative investments.

Most recent to announce their results is Chrysalis, Jupiter’s growth capital fund. A first quarter update of the trust revealed its Net Asset Value fell -13.2% during the fourth quarter last year, bringing a total loss of -38% for 2022.

This week we’re looking at what an investment trust is, what’s happened to the likes of Chrysalis, and the outlook for these types of investment.

What is an investment trust?

An investment trust is a form of collective investment vehicle traded on the London Stock Exchange, which invests in other publicly traded and private companies. The price of an investment trust fluctuates on the market, much like an individual company stock price does.

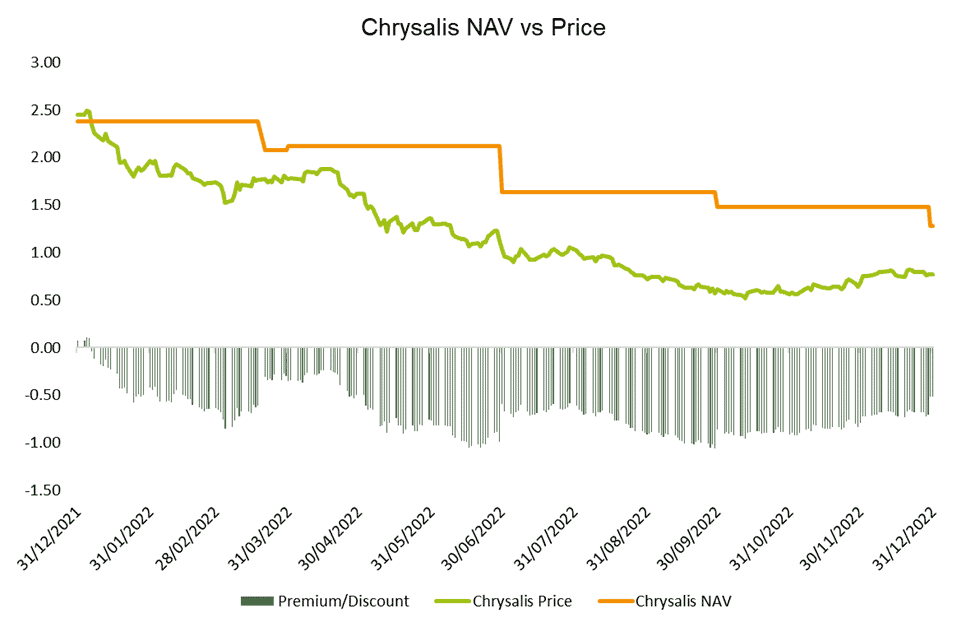

Whilst the price of an investment trust is reflective of supply, demand, sentiment and outlook (among other things) the Net Asset Value (NAV) of a trust is the per share value of all assets in its portfolio combined. The price of an investment trust and its NAV can therefore diverge from one another. If you pay a price lower than the NAV for an investment trust, you are buying shares of the trust at a ‘discount’. If you pay a higher price, you are buying at a ‘premium’.

What happened to Chrysalis?

As with many investment trusts, Chrysalis saw its NAV slump last year as the underlying prices of its assets fell, but its own price dropped even further to a large discount. The fall in NAV was due to a massive write-down of short-term credit provider, Klarna, as well as several newly listed companies seeing their share price retreat in the market falls we saw last year.

2022 was a tough year for growth stocks, and the share price of Chrysalis fell by 68%, opening up a discount of 40% by the end of the year (the trust began the year at a 3.0% premium!). The below chart highlights the divergence between share price and NAV.

Source: Morningstar

The fallout from last year saw investors less than impressed by the performance fee the fund management team received for the preceding year: Jupiter and management received approximately £112m of fees following an exceptional 2021. After last year’s poor performance, the board promised to revise the performance fee down from 20.0% to 12.5%.

Bowmore portfolios

Despite a volatile period for investment trusts in 2022, investors (including us at Bowmore) are gaining more confidence in the outlook for the space. Whilst not immune to the fallout that high inflation and rising interest rates has had on the sector, we held limited exposure to investment trusts over the period.

It is true that yield curves remain inverted and recessionary pressures persist, but revised valuations and extremely wide discounts within the investment trust world are offering very attractive long-term propositions for investors who can ride out short-term volatility and be selective in their approach. History shows us that as sentiment improves and investors return to the table, large discounts can be short-lived, with an opportunity to buy into markets not only at depressed levels, but for less than presently valued, and we are monitoring these opportunities with anticipation.